In high school, instead of Spanish, I took Latin as my foreign language. Looking back on it, I wish I had taken Spanish, but our Latin class did spend a significant amount of time studying Roman history which I found very interesting. One piece of history that has stuck with me is how the Roman calendar did not number each day of the month like the modern calendar. Instead, they counted back from three fixed points of the month: the Nones (the 5th or 7th), the Ides (the 13th for most months, but the 15th in March, May, July, and October), and the Kalends (1st of the following month).

In modern times, the Ides of March is best known as the date on which Julius Caesar was assassinated in 44 B.C. Caesar was stabbed to death at a meeting of the Senate. As many as 60 conspirators, led by Brutus and Cassius, were involved.

What does the Ides of March have to do with investing?

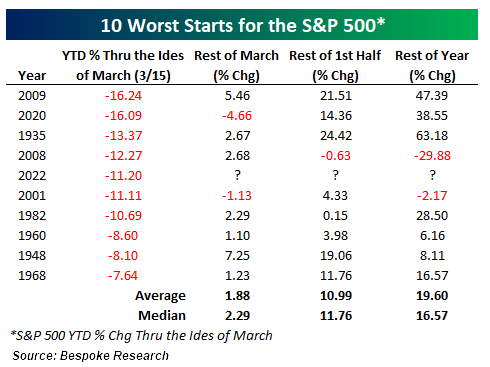

2022 has offered the 4th worst start to the year through the Ides of March as you can see below. It is worth noting that the average return through the end of the calendar year (last column) has historically been 19.60%. Obviously, past performance does not guarantee future returns, but we think history provides us with great perspective. Remember the old saying, “history may not repeat, but it often rhymes.”

What do we do with this information?

We think being a successful investor has a lot to do with managing emotions and also expectations. As we have written many times, humans are linear thinkers. If it has rained for the last 7 days, we think it is going to rain forever. Since the markets have been down for the last few months, even the most experienced investor can begin to doubt and think that stocks will never move higher again!

I am reminded of a famous quote by Herbert Stein who used to write for the Wall Street Journal. He said “if it can’t go on forever, it will stop.”

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Matt Price and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and investors may incur a profit or a loss. Past performance does not guarantee future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. 4551055