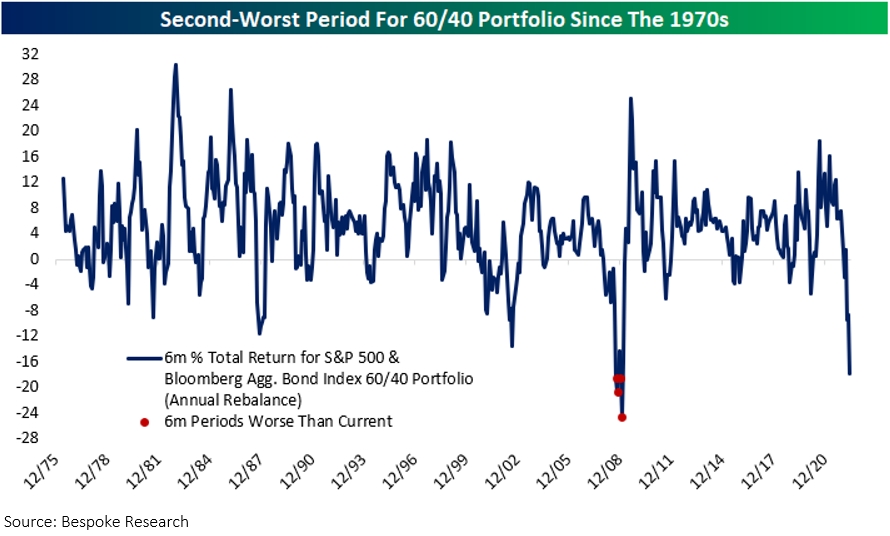

In 2022, the balanced 60/40 (60% stocks and 40% bonds) portfolio had its worst six-month start to the year dating all the way back to 1976. This is due to the combination of soaring bond yields and a bear market for stocks.

Outside of a few six-month periods starting in 2008 (see chart below), no other period comes close to the losses this year. With that being said, we understand this has been a very difficult year for long-term investors. As investors ourselves, we can sympathize and empathize with the pain and uncertainty.

The "average" investor is not only dealing with 7%+ inflation and $4/gallon gasoline, but is also experiencing the biggest shock to retirement portfolios since 2008. Even during the “Dot Com Crash” of the early 2000s, we did not see a six-month decline of this magnitude in the average balanced portfolio.

In terms of historical analysis, most of our work shows that if you have longer than a one-year time horizon, now is the time to consider putting additional funds to work rather than raising cash. Remember, the goal is to buy low and sell high, not buy high and sell low!

There's a reason the phrase "buy when there's blood in the streets" came into existence. Historically, it has worked. After the worst starting six-month period over the past 50 years, can we say there is "blood in the streets"? We think so, but time will tell!

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Rebalancing does not protect against a loss in declining financial markets. There may be a potential tax implication with a rebalancing strategy. Investors should consult with their tax advisor before implementing such a strategy.

An investment cannot be made directly in a market index.

The Bloomberg Barclays Capital U.S. Aggregate Bond index measures the performance of the U.S. investment grade bond market.

AdTrax 4766787.15 Exp 6/24