When I was 15, I took a driver’s education course along with most of my classmates. There were a few days of classroom work then they put you in a car in an empty parking lot. At a very slow speed, they let you maneuver the car through cones set up like a small race track. After that, they placed drunk goggles on the driver and had you repeat the same course. Needless to say, not one driver could complete the course without hitting one of the cones. It was a very compelling exercise to encourage teenagers not to drink and drive.

Over the past year, it has felt like we are looking at economic indicators with drunk goggles on. Historically, economic indicators have helped us determine where we are in an economic cycle and more importantly…. where we might be going.

Why have economic indicators been less clear?

The US and the rest of the world panicked in 2020. Governments around the world implemented unprecedented policies. The US borrowed and printed money at a rate never seen before in our country’s history. As we have written numerous times, inflation is very closely associated with the money supply. When the government issued checks to a majority of Americans, the money supply spiked and inflation followed about a year later. In addition to these historic monetary policies, there was a temporary shutdown of the world economy which continues to cause side effects 2+ years later.

Because of this, the US (and most of the world) had a temporary “sugar high” with a slow return to normal starting sometime last year.

Are we in a Recession?

It depends who you ask. The White House seems to have changed the definition of a recession. One could speculate that the mid-term elections coming up have something to do with the change of their definition?

Historically, the definition of a recession is two straight quarters of negative Gross Domestic Product (GDP). By that definition, we are in a recession. With that being said, the GDP is a very complex formula that involves many components of the US economy. Because of the recent “sugar high” and the slow return to normal, GDP appears to be weakening BUT the economy continues to look healthy. For example, unemployment figures moved lower last month. Corporate earnings continue to move higher. Industrial production has continued. The job market continues to be healthy.

The costs of the lockdowns continue to be felt years later. Voters will react which probably means legislative gridlock for the next two years as our country attempts to sort this out.

Timing of Recession

At some point, a “real” recession will come. Our best guess is the second half of 2023 or sometime in 2024. We do NOT expect a recession like we saw in 2020, or a repeat of the Great Recession in 2008-09. Our expectation is that the next recession will be more mild than the last two we have experienced. Why do we think the next recession will be more mild? The consumer is in a very healthy spot… the average person has a lot of cash on their balance sheet and does not have too much debt like we saw in 2007. In a similar fashion, companies have a lot of cash on their balance sheet when compared to historic averages.

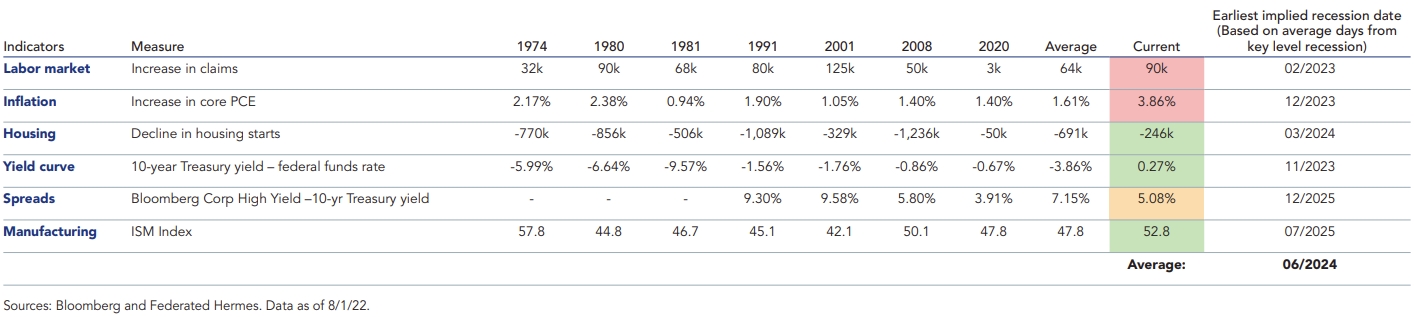

Below is a look at some leading indicators for recessions over the past 50 years.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

AdTrax 4766787.17 Exp 8/24