My wife (Emily) is the oldest of five children and grew up in the heart of San Antonio. Their family had a handful of “normal” pets like dogs, cats, and bunnies along with some obscure pets like chickens, goats, turtles, and turkeys. When Emily was just a child, she once approached the mother hen who was warming her nest of unhatched eggs in their backyard and the hen attacked Emily. Thankfully, Emily only got one peck to her upper lip!

Emily was attempting to count the eggs to see how many little chicks would join their family before the eggs hatched. And we all remember the ol’ saying… “don’t count your chickens before they hatch.” There is something to learn from this famous saying as it pertains to the current inflation debate.

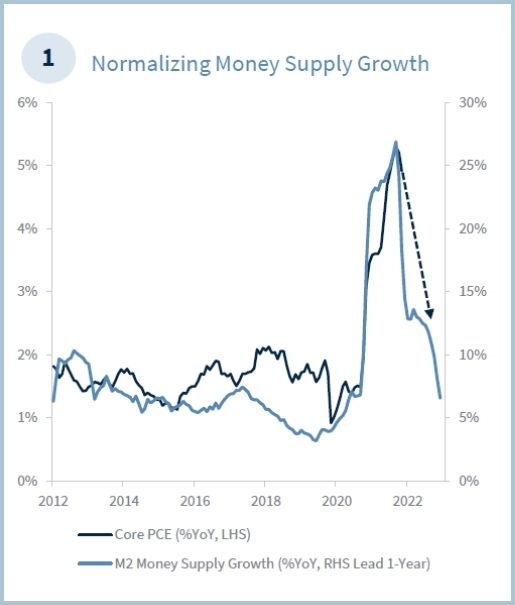

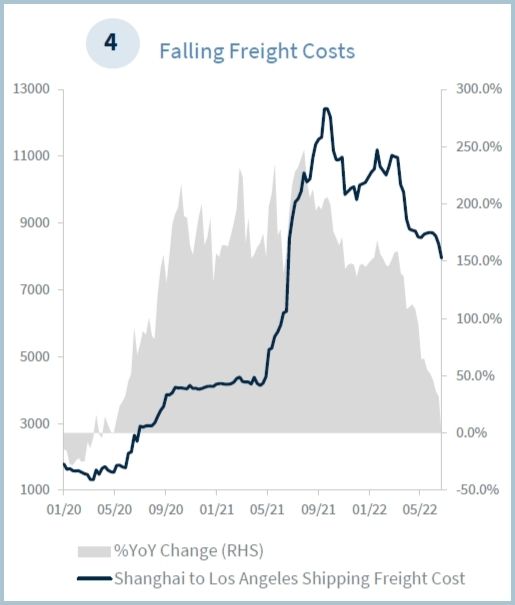

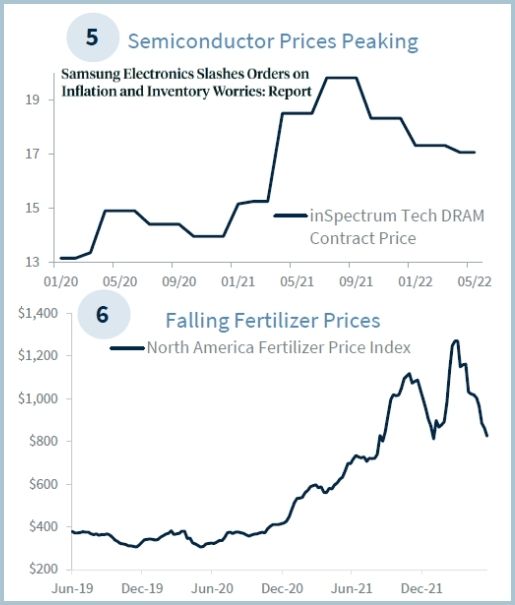

We have been writing since the Spring that we think inflation will start to “roll over” or dissipate this fall. We believe there is mounting evidence to support this claim. Below please find seven (7) pieces of evidence to support our claim with the most important component being #1… the normalization of the money supply growth.

Source: Raymond James; Data Source: FactSet, Data as of 6/30/22

While we feel like inflation should start to dissipate, we have not seen it happen yet. Earlier this month, the Consumer Price Index (CPI) which is a measure of inflation came in above expectations. This means inflation is not dropping as quickly as some experts had predicted.

We also believe that the stock market has already priced in a mild recession sometime in the next 12 – 24 months. If/when inflation does start to dissipate, we think you could see the stock market start to move higher. The unknown of how long inflation will stick around seems to be the main headwind for the stock market.

Is our fall timeline expectation still going to happen? Let’s count our chickens after the eggs hatch.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

AdTrax 4766787.18 exp 8/24