Many economists will say that the most powerful man in the world is NOT the President of the United States of America but the Chairman of the Federal Reserve. Why you might ask? Let us explain.

What Does the Federal Reserve Do?

The Federal Reserve (Fed) is the central bank of the United States. It was created in 1913 following several severe financial panics. The Fed’s obligations include conducting monetary policy, regulating the country’s banking sector, providing banking services, and supervising the financial system. Through its actions, the Fed wants to keep inflation stable, promote economic growth and ensure maximum employment.

The Fed is “supposed” to operate as an entity free of politics as the Fed Chair (currently Jerome Powell) is not an elected official. Mr. Powell along with the other vice chairs make decisions that directly impact the lives of every American. The Fed has the following “day to day” responsibilities:

- Sets short term interest rate policy

- Control the money supply

- "Point person” during a financial crisis like 2008 and 2020

- Decides if the economy is over-heating

- Sets targets for the inflation rate

- Controls the value of the world reserve currency (U.S. dollar)

- Oversees banking regulation

While the Federal Reserve has other duties, these are some of the most important responsibilities.

History of the Federal Reserve

The Federal Reserve’s response to the 1929 depression was to NOT intervene with free markets. They made the decision that the best way for capitalism to move forward was to allow failure of the weakest parties and have the strongest survive. There is considerable debate on whether the 1929 depression that lasted for years could have been partially avoided with a more accommodative Federal Reserve.

During the 2008 financial crisis, the Federal Reserve drastically changed the way it manages the value of our currency when it shifted monetary policy from a “scarce reserve” model to an “abundant reserve” model.

Policy Today vs. Policy of the Past

In a scarce reserve model (pre-2008), the Fed can add or subtract reserves from the banking system and also influence the movement of short-term interest rates. For example, higher interest rates would slow economic activity and inflation and have an impact on the banking system.

In an abundant reserve model (post-2008), there are so many excess reserves that banks don’t need to compete for them. The short-term interest rates are essentially zero because only in very special situations do banks need to borrow reserves.

In summary, the free market was involved in setting interest rates under the old system. One could argue that the Fed now artificially sets interest rates.

Money Supply Is the Key

As we have written many times, the amount of money circulating in the economy determines inflation. The Fed’s balance sheet held $850 billion in reserves at the end of 2007. Today, it is close to $9 trillion.

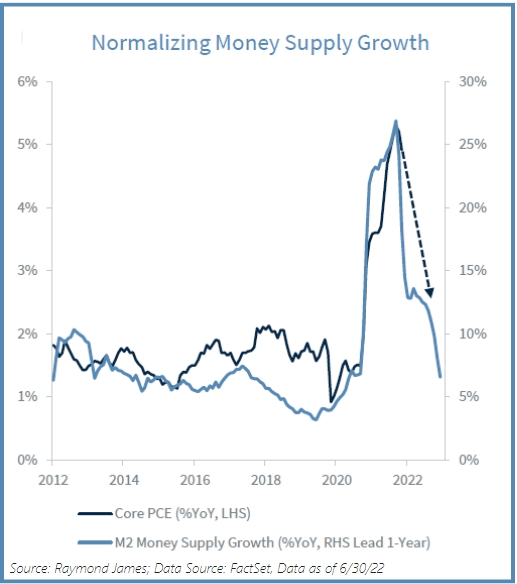

The good news… The money supply seems to be slowing at a quick pace. If/when inflation moves lower, it will not be because of higher interest rates but from a reduction in the money supply. As you can see below, the growth of the money supply has come down significantly since the pandemic.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

M2 is a calculation of the money supply that includes all elements of M1 as well as "near money." M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, and other time deposits. These assets are less liquid than M1 and not as suitable as exchange mediums, but they can be quickly converted into cash or checking deposits.

Federal funds rate is the interest banks charge each other to borrow money overnight. Changes in the federal funds rate influence the interest rates on loans, credit cards, and bank accounts. The federal funds rate is the key tool the Fed uses to stimulate or slow down the economy.

The Consumer Price Index (CPI), as provided by the Bureau of Labor Statistics, measures price fluctuations in a basket of goods and services purchased by American households. The year over year change of the CPI, is the most popular way of determining the rate of inflation. It is published monthly and sometimes referred to as the cost-of-living index

AdTrax 4766787.21 Exp 9/24