My wife and I have enjoyed watching the show Alone after our kids are in bed. The show involves sending 10 individuals into a remote part of the world and providing each of them with only a few necessary tools like a tarp or fishing line. Each contestant films themselves and has no human interaction for weeks – months. The objective is simple… the person who can stay in the wilderness the longest wins $500k! In the most recent season, the contestants were sent into Grizzly territory in Canada.

When a Grizzly bear attacks its prey, it attacks by moving its oversized paw towards the ground in a descending fashion. This is where the term “bear market” comes from… a market that is moving lower. In a stark contrast, a Bull attacks its opponent by moving its horns higher (i.e. bull market).

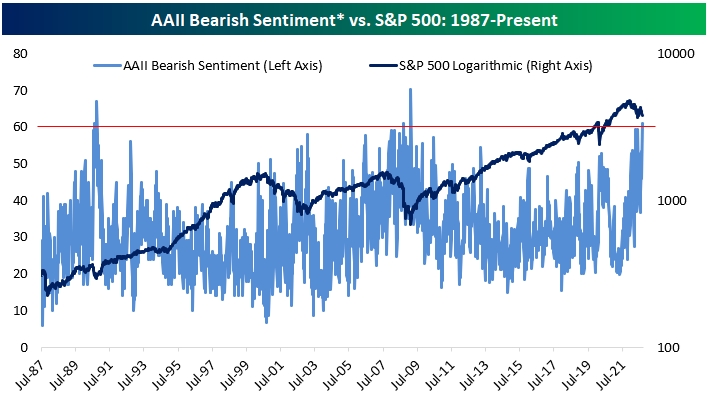

With that refresher, bearish sentiment is a metric that has been tracked dating back to 1987. This survey tracks how many people are feeling negative about the stock market for the next 6 months.

As you can see below, the most recent survey ending 9/21/22 revealed the 3rd most negative reading on record only behind the late 1980’s and the 2008 financial crisis.

Source: Bespoke Research

Why This Matters

Historically, this bearish sentiment has been a contrarian indicator. This means that retail investors typically feel most pessimistic at the exact wrong time. Warren Buffett says it another way… his famous quote is “I get fearful when others are greedy and I become greedy when others are fearful.”

The Bad News

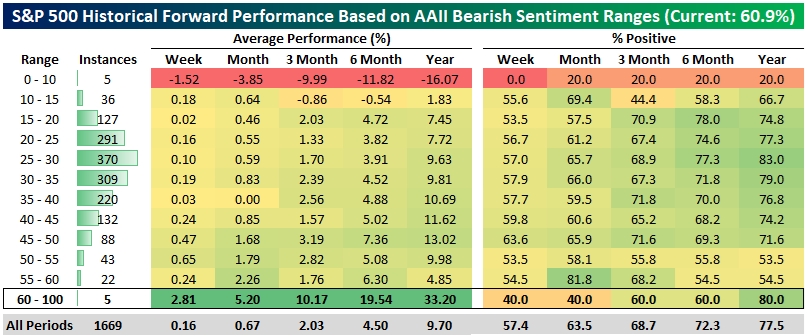

This negative reading does NOT mean that stocks will move higher immediately. When we look back at the other two negative periods of bearish sentiment, it has taken weeks – months for stocks to move higher after an extreme reading like this.

The Good News

After a bearish sentiment reading this negative, the average return over the following 6 months is +19.54%. Over the next 12 months, the average return is +33.20%. Obviously, past performance does not guarantee future results but history does suggest that brighter days are ahead for the equity markets.

Source: Bespoke Research

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

AdTrax 4766787.23 Exp 9/24