My family and friends know that I am a country boy at heart and LOVE biscuits… especially with sausage gravy. While not at all healthy, biscuits are true southern comfort food and take me back to my childhood in east Tennessee. The BEST biscuits I have ever tasted were made by my grandmother – we called her Nannie. She was a strong woman, an amazing cook, and part of the greatest generation ever. She worked in an East Tennessee plant during the war that manufactured explosives and then went home to feed her family and help run the family farm.

When I first moved to Houston and could not find comparable biscuits, I sought out Nannie’s “secret” recipe. It was rather simple… she used lard for making her biscuits (from scratch) and cooked them in a special cast iron fry pan. The lard made the biscuits extra flaky and the fry pan (her house did not have the luxury of an oven) made them crunchy on both sides. Her spicy sausage gravy was made from a fresh killed hog and was great with eggs fried in grease.

This trip down memory lane makes me hungry… and also reminds me of the similarities to the way our team manages the equity/stock portion of our client portfolios. We definitely have a “secret” recipe in the way our equity portfolios are constructed. Just like my grandmother’s biscuits were made with common ingredients, our secret recipe is really all about our investment process.

The Price Group’s Investment Process For Stocks

Since retirement is all about income, we utilize dividend stocks for a large portion of our stock allocation. When appropriate, we utilize several “flavors” of dividend stocks but our overall recipe is to produce consistent re-occurring revenue for the families that we serve. If we are doing our jobs correctly, our clients should benefit from quarterly dividend payments and also from ongoing increases in their dividend income each year.

It has been interesting to listen to many of the “experts” on the various financial shows during this recent period of volatility in both stocks and bonds. Two re-occurring questions are asked on a consistent basis: 1) How to invest during inflation? and 2) How to invest during a recession? The answer typically touches on the benefits of stocks that produce income and should be able to increase their dividends for the foreseeable future.

We thought it helpful to remind our readers of the many benefits of dividend stocks and also why we think dividend stocks are an advantageous investment moving forward:

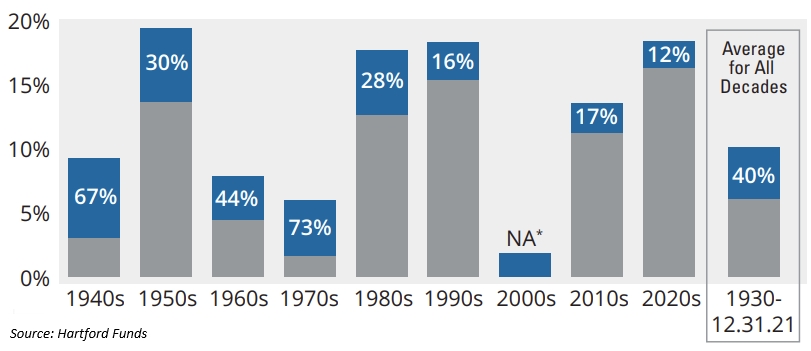

(1) Lower investment returns. We are of the belief that investment returns over the next 10 years will be less than the past 10 years. In periods like this, stock dividends will likely be a larger portion of a stock’s total return. Historically, dividends have averaged approximately 40% of the market’s total return (see chart below). In contrast, over the past decade dividends have contributes less than 20% of the S&P 500’s total return.

Contribution of Dividends to Total Return

(2) High cash balances. Corporations have a lot of cash on hand as their balances have tripled since the early 2000’s1. Because of this, conditions are supportive of dividend growth in the years ahead. Historically, the dividend payout ratio has averaged 48%. Currently, the average company’s payout ratio is about 31%, thus leaving companies the flexibility to increase dividend payouts.2

(3) Change in tax policy. The recent “Inflation Reduction Act” enacted a 1% surtax on company stock share repurchases which will take effect in 2023. S&P 500 companies spent about $6 trillion on stock repurchases in the ten year period from 2011-2021.3 It seems logical to assume that a lot of these same companies will reduce share buy-backs and allocate this extra cash to return to shareholders via increases in their dividends.

(4) Inflation protection. The companies we favor have a propensity to increase their dividend each year. An increasing dividend stream will help offset inflationary pressures as your cost of living continues to rise in retirement.

(5) Track records matter. Companies that pay sustainable and growing dividends have a good track record of being efficient allocators of capital3. With the stress of higher interest rates and also inflation, the healthier companies with stronger capital flexibility should have an extra advantage.

(6) Demographics. An aging population will continue to favor dividend stocks as an attractive growth/income option. Even though interest rates have risen, they are still low from historical standards.

In summary, we believe dividend stocks are well positioned in the current environment and make a good “recipe” for the retiree.

Bon appetite!

About The Author

Randy Price serves as a Partner and an Executive Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Lindy, and the family golden retriever. Lindy and Randy are recent empty nesters as their five children have all moved out of the house. Over the past 30+ years, Randy has helped families find comfort, confidence, and clarity regarding their wealth and their legacy. Randy firmly believes that everyone needs a wealth coach!

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease or totally eliminate their dividends without notice.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

AdTrax 4766787.19 Exp 9/24