According to a recent study, asking your boss for a raise was considered one of the top anxiety causing conversations in the work place. Consider another LinkedIn survey of 2,000 professionals from around the world:

- 39% of American professionals are anxious about negotiating.

- 26% of women feel comfortable negotiating compared to 40% for men.

- Of the eight countries surveyed, professionals in the U.S. were the most anxious about negotiating.

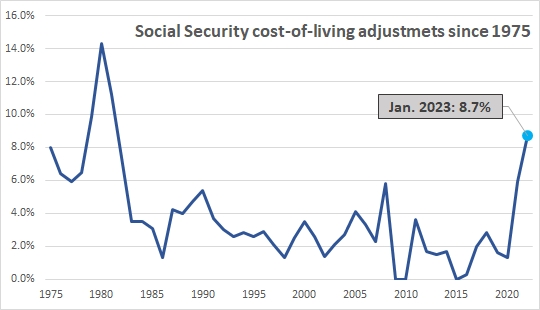

But there is good news… you will not have to ask for a raise from Uncle Sam for your Social Security paycheck in 2023! You will be receiving a 8.7% raise from Social Security starting in January 2023. This represents the largest raise in over 40 years!

History of Social Security Cost-Of-Living Adjustment (COLA)

Each year, many of our clients eagerly await their cost-of-living adjustment (COLA) in the hopes of getting a higher monthly paycheck. Since 1975, retirees have received a COLA to help their benefits keep up with inflation. But in recent years, those COLA's have been notably stingy or non-existent. It is also interesting to note that the government does not factor food or energy into the COLA calculation - I am still looking for that person who does not consume food or energy in their daily life. But Uncle Sam didn't ask for my opinion!

Will I really get a raise?

Before you plan that beach vacation with your “raise,” let's remember most retirees do not see their COLAs in full because of the "hold harmless" provision. The provision states that Social Security recipients cannot see their benefits go down as a result of Medicare increases. Though this provision is designed to protect retirees from Medicare premium increases, it is also the reason why beneficiaries may not notice much of a change in their Social Security payments in the upcoming year.

Medicare Part B, which covers doctor visits, diagnostics, and preventive care is not “free” like Part A. The Part B premium can increase each year. Since many of our clients pay for Medicare directly through their Social Security benefits, when Part B increases more than the COLA, enrollees are only on the hook for the lesser of the two. This means that if Part B goes up 5% in a given year but Social Security's COLA is only 3%, beneficiaries only will pay 3% more for Medicare.

Do you have a strategy?

Reviewing your Social Security filing strategy can be a daunting task. There are over 80 ways for a married couple to file for Social Security benefits. Before you try to decipher these complex government benefit programs alone, please give us a call. We would be happy to help.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

AdTrax 4766787.29 Exp 10/24