For many Americans, Social Security is a crucial component of their retirement plan. Unfortunately, there are a lot that people who have made inaccurate assumptions about how Social Security works. To make matters worse, we believe that the Social Security Administration (SSA) office will offer little-to-no guidance because they are already spread thin administering benefits to approximately 64 million Americans.

Here at The Price Group, we can offer the advice needed to help maximize your Social Security benefits as you approach retirement.

Below please find 5 secrets that the Social Security Office might not bring to your attention:

1) Full Retirement Age (FRA) Is Not Best For Everyone

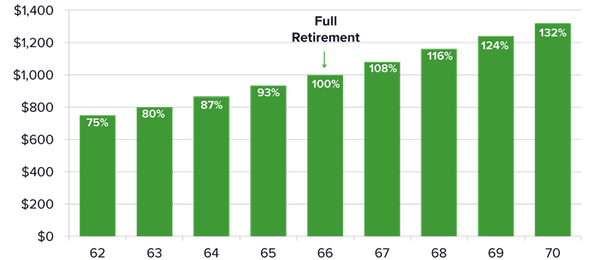

It’s often assumed that FRA (age 66 – 67, depending on when you were born) is when you should start taking your Social Security benefits. What you might not know is that you can increase your annual lifetime benefit by 24% - 32% by deferring your Social Security payments until age 70.

Assume that your FRA is 66 and your full benefit would be $1,000 per month. If you start benefits early at age 62, you'll receive 75% of your total benefit amount, or $750 in our example, for the rest of your life. And each year you delay claiming Social Security benefits, your benefit amount increases by 8%. If you wait to take Social Security benefits until you are 70, you'll receive 132% of your total benefit amount, or $1,320 a month, for the rest of your life. Tell us how long you plan to live and we will tell you exactly when to file for Social Security benefits!

Source: Social Security Administration. Assumes birth 1943-1954 with hypothetical $1000/month FRA benefit.

2) Your Break-Even Is Important… To An Extent

The "break-even" age is the age at which you come out ahead if you opt to delay receiving your Social Security benefits. Your break-even age will shift depending on the amount of your FRA benefits and the age at which you begin receiving Social Security.

If you are relatively healthy and have a history of longevity in your family, there’s a greater likelihood that you will reach your break-even age. We illustrate this concept below with a life expectancy of 92 and an FRA of 66. In this case, delaying the benefits until FRA instead of taking them at age 62 puts their break-even age around 75 and increases their lifetime benefits by over $100,000. Delaying the benefits even further to age 70 puts their break-even age around age 79 and increases their lifetime benefits by over $200,000.

Source: Social Security Administration. Estimates are shown in today's dollars and based on assumptions for someone born 1/1/1949 earning the Social Security wage base maximum since 1976 or earlier. No cost-of-living adjustments, inflation estimates or reinvestment rates are included.

However, if you are married the “break-even” calculation becomes more murky. An example is the best way to explain… let’s say a husband had the only Social Security record because the wife did not work outside of the home. The wife will be entitled to the spousal benefit or 50% of her husband’s benefit. What if the husband passed away at 75 after deferring benefits until age 70? The break-even only on the husbands life would lead us to believe this was the “wrong” decision; however, the wife will now receive that higher Social Security benefit for the rest of her life.

The bottom line is this… we do NOT fully rely on a simple break-even because the surviving spouse could live another 10, 20, or even 30 years using the higher benefit. There are many other factors that should be considered instead of just looking at the break-even calculation.

3) A Guaranteed 8% Rate of Return

There is no investment that can offer you a guaranteed 8% rate of return. Yes – your investments could generate that rate of return but the returns are not guaranteed. Every year you defer your Social Security payments past your FRA, you are guaranteeing an 8% increase in your future benefits for the rest of your life.

At times, we advise clients to withdrawal more from their investment portfolio with the goal of maximizing their Social Security benefit. While this strategy does not make sense for all investors, it is an important consideration and something we study in detail when creating a Live Well Plan.

4) Don’t Count on Cost-Of-Living-Adjustment (COLA) Raises

Depending on the rate of inflation, the government will at times provide a cost-of-living-adjustment to Social Security benefits. Most retirees do not see their COLAs in full because of the "hold harmless" provision. Though this provision is designed to protect retirees from Medicare premium increases, it is also the reason why beneficiaries may not notice much of a change in their Social Security payments even when the Social Security Administration announced an increase in benefits.

Medicare Part B, which covers doctor visits, diagnostics, and preventive care is not “free” like Part A. The Part B premium can increase each year. Since many of our clients pay for Medicare directly through their Social Security benefits, when Part B increases more than the COLA, enrollees are only responsible for the lesser of the two. This means that if Part B goes up 5% in a given year but Social Security's COLA is only 3%, beneficiaries only will pay 3% more for Medicare.

5) The Federal Government Can Tax Social Security Benefits

Most people are not aware that the federal government will tax your Social Security benefits. Whether or not your Social Security will be taxed is based on “combined income.” You add your gross income, tax-exempt interest, and half of your Social Security benefits to determine your combined income. Then, depending on your tax-filing status, you have to pay federal income taxes on your Social Security benefits if your combined income exceeds a certain level.

What Is The Best Way To Maximize YOUR Social Security Benefits?

Since there are over 80 different filing strategies available to a married couple, it is critical to do the proper Social Security planning prior to filing for your Social Security benefits. In our humble opinion, each family needs to spend time planning for this important piece of your retirement. At The Price Group, we do this by incorporating the all-important Social Security planning into our Live Well Plan. If you want to develop a Social Security strategy to optimize your benefits, give us a call.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Steward Partners Investment Solutions, LLC (“Steward Partners”), its affiliates and Steward Partners Wealth Managers do not provide tax or legal advice. You should consult with your tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

AdTrax 4766787.38 Exp 1/25