What Is The Rule of 72?

My wife, our two daughters and our golden retriever have never showed any interest when I have wanted to talk about compound interest. You can’t blame them though – right? I realize this is not a great conversation for a date night or your next dinner party BUT the Rule of 72 can be invaluable when forecasting assumptions for your retirement game plan. While figuring out compound interest is relatively simple with a calculator, the Rule of 72 allows you to do a mental calculation (i.e. cowboy math in Texas) to illustrate the effects of compound interest without having to use the calculator app on your phone!

Albert Einstein described compound interest as “the most powerful force in the universe”. WOW! In the most simple of terms, compounding interest means earning interest on interest over and over again. This means that each AND every time interest is paid, it is paid on an increasingly larger balance. The Rule of 72 can help you easily calculate how long it will take to double your money using various rates of return.

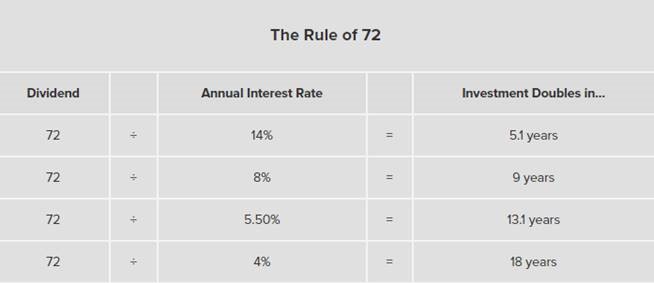

72 ÷ your compound annual rate of return = number of years it takes for your investment to double

This chart is for illustration purposes only

Helpful application of The Rule of 72

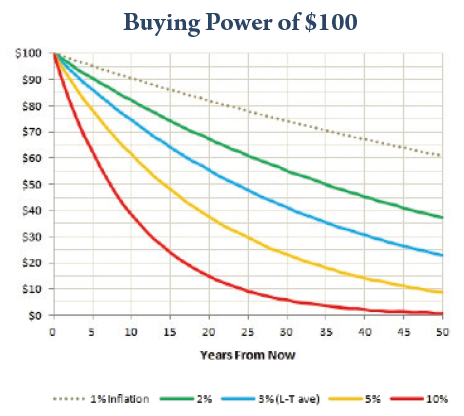

- Cost Of Living Projections (i.e. inflation): This same simple formula can help you estimate how long it will take your cost of living to double in retirement. To do this, take 72 and divide it by the estimated inflation rate. The answer will tell you how long it will take your cost of living to double. For example, your cost of living will double in 24 years with a 3% inflation rate. At a 6% inflation rate, the cost of living would double in 12 years. Some retirees could see their cost of living double once or even twice during their retirement!

- Growth of Dividend Income: When it comes to dividend stocks, we can use the Rule of 72 to determine how long it will take for our stock dividends to double. For example, if our dividends grow at 6% each year, our dividend income stream will double in 12 years. This is one of the reasons many clients utilize our Dividend Growth strategy. We focus on companies that have a propensity to maintain and also increase their dividends each and every year.

- Start Date for Retirement Savings: While most of our clients and blog followers are retired or planning to retire soon, this topic might not apply directly to you. With that being said, you probably have a child or grandchild just starting their career. For them, this tip is VERY valuable. Bottom line… the earlier you can start saving for retirement, the more time there is to have your money work for you.

Example: Let’s assume you start saving at age 25, and put aside $3,000 a year in a tax-deferred retirement account for 10 years - and then you stop saving - completely. By the time you reach 65, your $30,000 investment will have grown to more than $338,000, (assuming a 7% annual return), even though you did not save a dime beyond age 35.

Now let's say you “enjoyed the good life” and put off saving for 10 years until age 35 and then you started saving $3,000 a year and faithfully did this for 30 years until you retired at age 65. By this time, you will have invested $90,000. BUT, assuming the same 7% annual return, your retirement nest egg would only have grown to about $303,000. That's a huge difference!

Start saving EARLY and save OFTEN! Put the time value of money on your side.

Takeaway

The Rule of 72 is a time-proven method to predict the time needed for a portfolio or income stream to double. At The Price Group, we develop a Family Index Number for your retirement. Your Family Index Number is a personalized measurement developed to define and track the progress of your portfolio as it pertains to your Live Well Plan. This number represents the rate of return needed from your portfolio assets in order to achieve your goals and objectives with confidence.

The Family Index Number replaces complexity with clarity by helping clients understand the rate of return their portfolio needs to earn over time to meet their needs. Knowing your Family Index Number will not only help you meet your needs, but also reduce the stress of trying to outperform a volatile index. As mentioned, we like dividend paying stocks for our retired clients to supplement fixed income and most likely to provide for an increasing income stream in retirement. This is one of the most efficient ways to fight inflation in retirement.

Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Not all strategies mentioned may be suitable for all investors. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. The above examples are hypothetical for illustration purposes only. Actual investor results will vary. Dividends are not guaranteed and must be authorized by the company's board of directors. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Matt Price and not necessarily those of Raymond James.