Introduction

A recession (i.e. two consecutive quarters of negative GDP growth) is coming. We guarantee it. Unfortunately, we do not know when. It is kind of like saying we know another hurricane will hit Houston. We know it will but we just do not know when. Recessions will continue to happen as long as economic data is tracked with some degree of certainty. With that being said, the better question to ask could be “What can help us identify the next looming recession?”

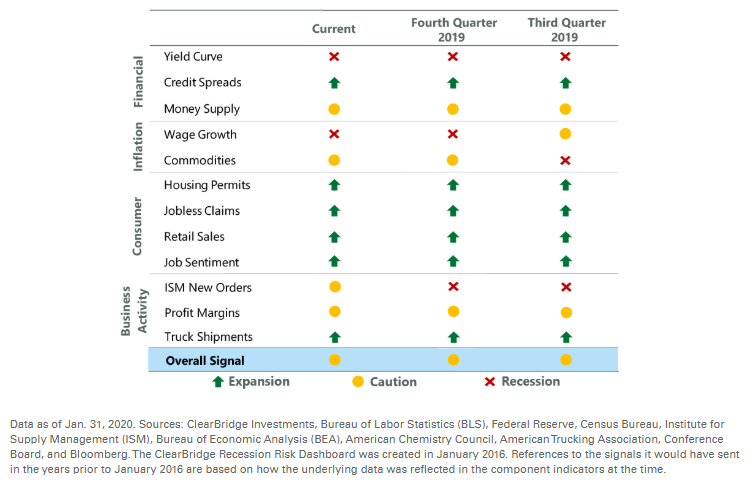

The Price Group Recession Dashboard

The Negatives

- Inverted Yield Curve: Parts of the yield curve are inverted – 5 year bonds are currently yielding less than cash alternatives. Historically, this inversion of interest rates has happened prior to most every recession. With that being said, history tells us that an inverted yield curve does NOT always produce a recession. A good analogy would be… it always rains before a hurricane but rain does not always lead to a hurricane.

- Wage growth: Companies continue to be more profitable but you are not seeing wages increase at the same pace. This can become problematic because the consumer is responsible for a majority of the economic activity in our country. If employees are not getting raises, they are not spending as much money.

The Positives

- Healthy consumer: American households are in a strong financial position with robust balance sheets. Household leverage is the lowest it has been since 1985.

- Company Earnings: Earnings are definitely slowing but they still look healthy. We have written in the past that earnings growth could grow at a slower pace but this was to be expected.

- Corporate Balance Sheets: Large companies here in the U.S. are still flush with cash.

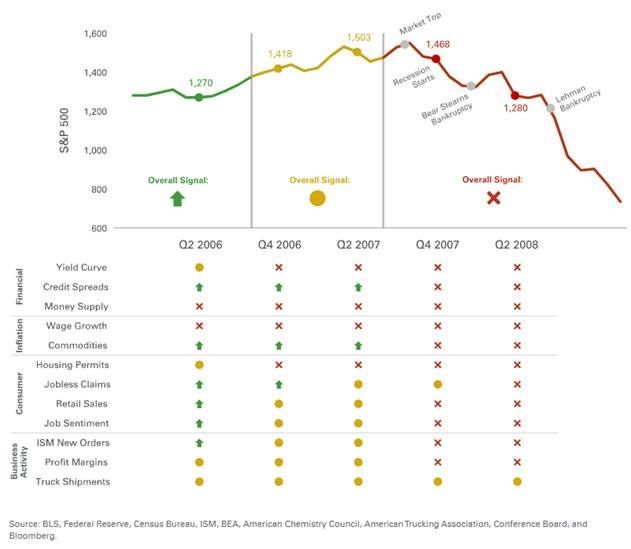

A Look Back At 2008

We do not think the next recession will be as severe as the last recession of 2008 – 2009. The same logic applies to hurricanes… Houston is fearful that every hurricane will be like Hurricane Harvey. Humans tend to think in linear fashion – whatever has happen recently will continue to happen in the same way moving forward. We obviously cannot predict the future (our crystal ball is a little bit fuzzy) but we think the next recession will be more mild than the 2008 financial crisis.

Take Away

We remain vigilant in our study and due diligence to track economic activity and make changes as needed to protect client capital. We remain of the opinion that a recession is not imminent. To be clear, we are not saying stocks will go up in the coming weeks or months. Corrections happen. But, given the level of corporate profits and our outlook for economic growth, we think that equities will move higher for 2020.

About The Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their two daughters and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 9 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!