2020 has certainly been a roller coaster of a year and the ride is not over yet. The days, weeks, and months leading up to the November 3 presidential election are going to be full of drama, noise, and confusion. Because of this, we created this resource to provide perspective which will hopefully lead to additional comfort, confidence, and clarity about your investment portfolio.

The Polls

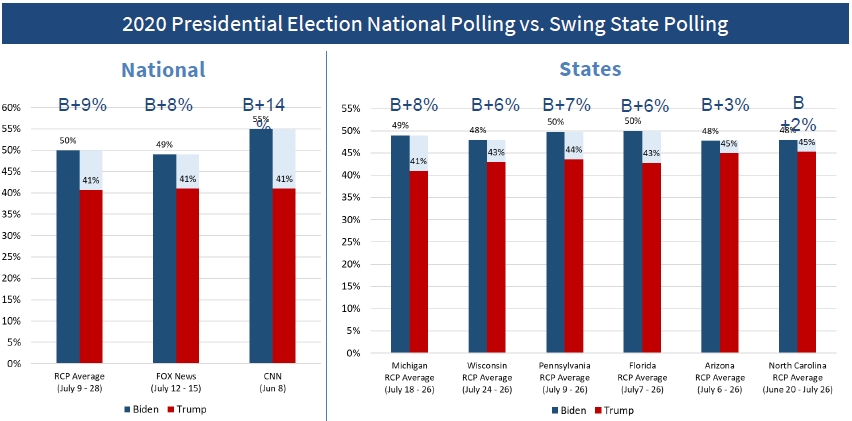

The polls got it wrong in 2016 which is leading many voters to pay little attention to the polls during this election season. It is also worth noting that the polls do a better job of tracking the popular vote – not the electoral college vote. Regardless of which side of the aisle you sit on, no one would label the media as a “truth teller” this year. The media has a vested interest to shape the narrative in order to produce more “clicks.” Their goal is a story that will produce the highest ratings. Because of this, we are paying less attention to the polling figures this election cycle.

Below is a look at the current national polling numbers and also the polling numbers in six key swing states.

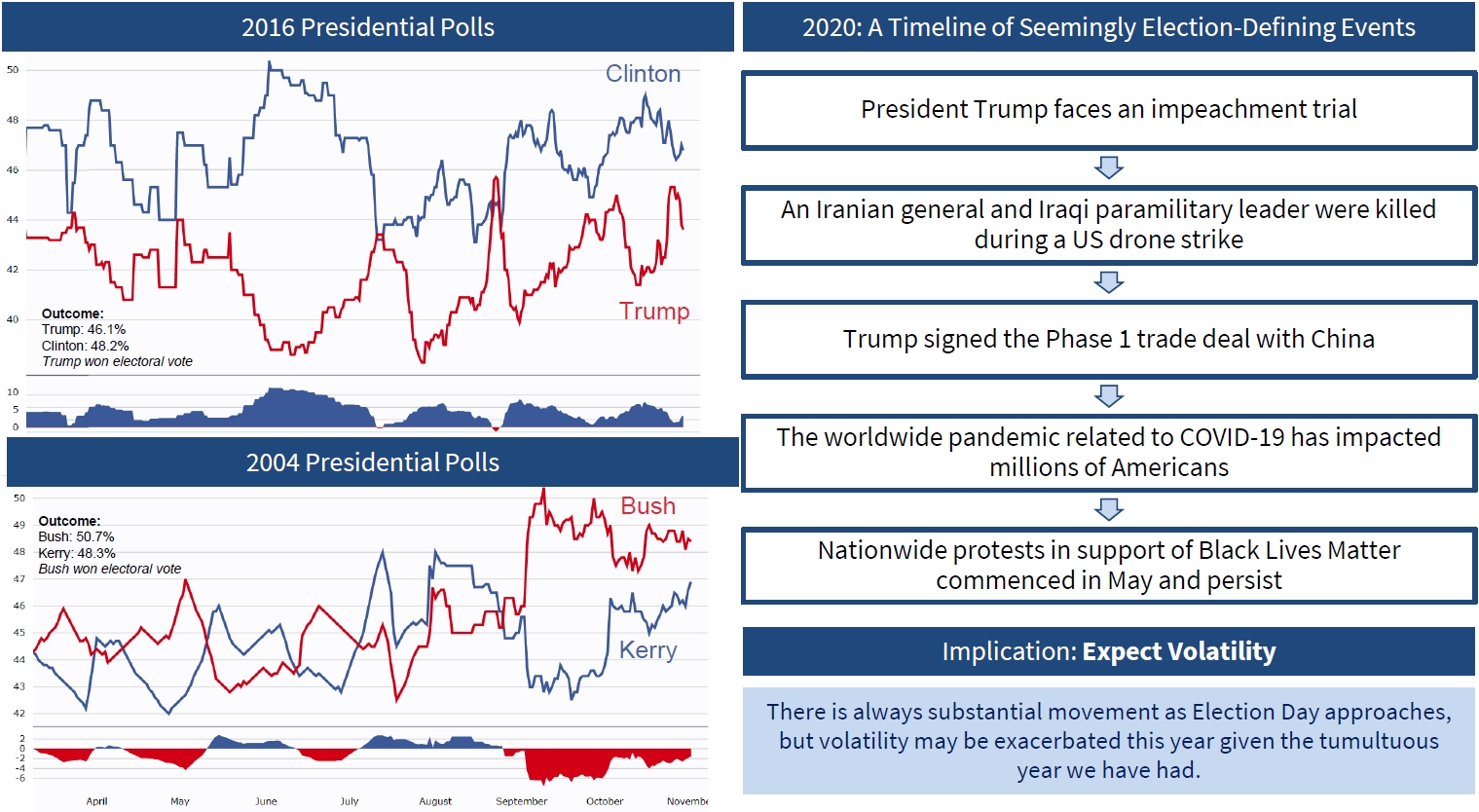

November 3 Is A Long Way Off

60+ days is an eternity in the world of politics. We took a look back at the 2004 and 2016 polls leading up to election day. We also note how MUCH has happened so far in 2020.

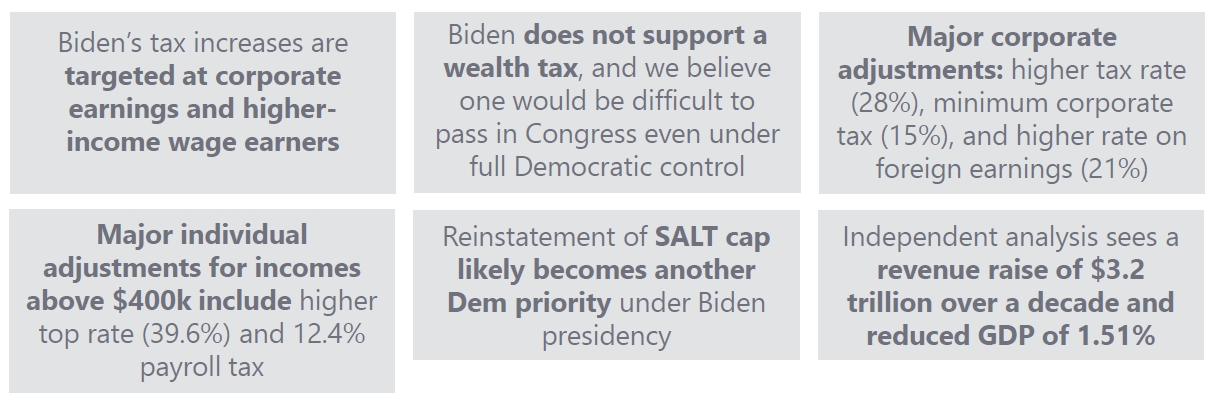

Biden's Tax Policy

Biden has been very forward in that he wants to raise individual taxes, corporate taxes, Social Security taxes, convert capital gains tax rates to ordinary income rates, and more. Below is an executive summary of what Biden’s tax policy entails.

- Corporate tax rate raised to 28% (from 21% under Tax Cuts and Jobs Act of 2017)

- Top income tax rate raised to 39.6% on incomes $400k+ (from 37% under TCJA)

- Long-term capital gains and dividends taxed at ordinary income tax level on income $1m+. Step-up basis calculation eliminated for capital gains

- 12.4% social security payroll tax for income $400k+ between employer/employee

- Foreign subsidiary income tax (GILTI) raised to 21% (10.5% under TCJA)

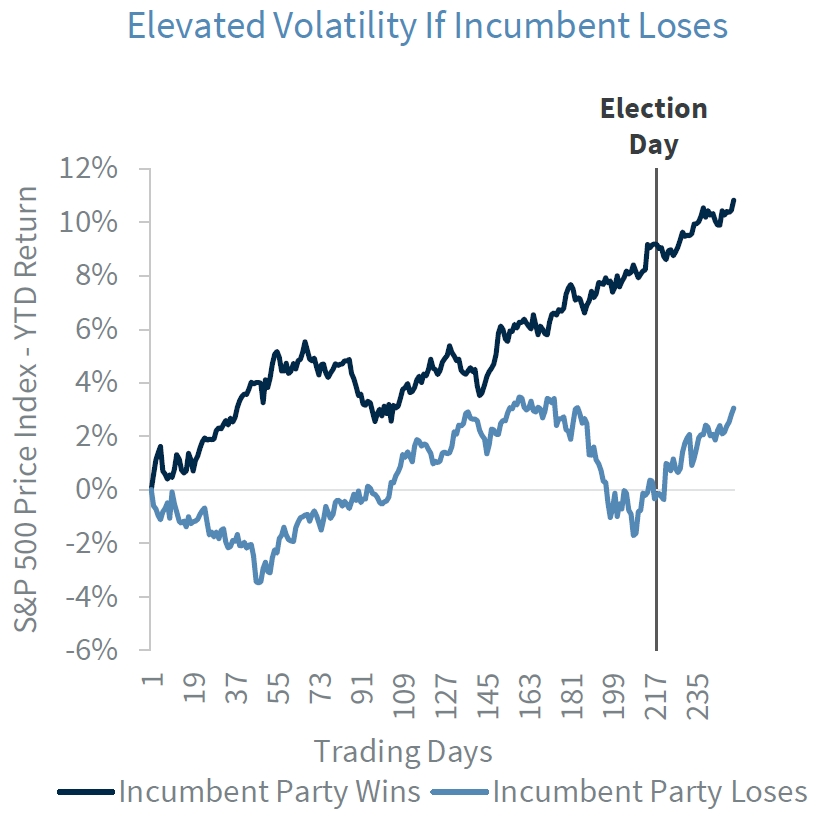

Equity Markets Know Best

The performance of the S&P 500 in the three months leading up to an election has accurately predicted the outcome for the last eight Republican incumbents. When the index's return was positive for the three months prior to election day, the Republican incumbent won. When the index's return was negative, the Republican incumbent lost. As you can see below, history also tells us that a stock market selloff prior to election day signals an incumbent loss.

Questions & Answers

As you might imagine, we are getting a lot of questions pertaining to the election so we wanted to share some of the most frequently asked questions and our answers:

Q: The market has come back quickly… should I reduce my allocation to stocks before the election?

A: Unfortunately, no one knows who will be elected in November. Because of this, our recommendation is to trust your investment process. This year has been a great reminder that stocks can move lower (or higher) very quickly and timing the market is not a sustainable investment strategy.

Q: Do you have a different strategy if Biden wins vs if Trump wins?

A: Yes and no.

Yes – we need to be ready to change various portions of our income tax planning if Democrats sweep in November. This might involve harvesting capital gains this calendar year, ROTH conversions, etc. prior to income tax rates potentially moving higher. We might take another IRA distribution this year so clients can reduce their taxable income next year. Also, there could be some “tweaks” to our stock portfolios given the ramifications of a change in leadership.

No – we are not going to abandon our investment process. As our clients know, our investment process is built upon repeatable and predictable income from interest and dividend payments.

Q: I think Biden is going to win. Should I sell some stocks now?

A: This is a dangerous game because no one actually knows. Once again, this is called market timing, and as Warren Buffett says, “neither I nor you are smart enough to predict where the stock market will be a year from now.” We recommend taking Warren’s advice and sticking to a disciplined investment strategy. Our investment strategy uses high quality companies that have a propensity to pay (and hopefully increase) their dividend each year. A change in the Oval Office should not affect the dividend payments of the companies that we own. However, it could be an impediment to future dividend increases. Stay tuned… we will know more as the process unfolds.

Q: Remind me of what your retirement planning process entails?

A: We start with creating a Live Well Plan so you know exactly how much risk you NEED to take to achieve your retirement goals. During this process, we determine your Family Index Number. This will help you understand what rate of return you need from your investment portfolio. With this information, we create a personalized investment portfolio (stocks, bonds, cash, etc.) designed to produce reoccurring income with liquidity to meet your retirement cash flow needs.

Q: Why should dividend stocks give me comfort during a difficult year like 2020?

A: Income, income, income. This is vitally important to everyone that is retired or approaching retirement. It is also worth noting that 43% of the total return of the S&P 500 has come from dividends (statistic dating back to 1940). Because of this, companies that can continue to pay dividends during turbulent periods not only reduce your overall investment risk but also have performed better historically.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their two daughters and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Any opinions are those of The Price Group and not necessarily those of Raymond James. This material is being provided for informational purposes only and is not a complete description, nor is it a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Raymond James and its advisors do provide tax advice. You should consult with a tax professional in regards to your particular situation. The indexes mentioned are unmanaged and cannot be invested into directly. Dividends are not guaranteed and must be authorized by the company's board of directors. Past performance is no guarantee of future results. Sources: RealClearPolitics, FactSet, Raymond James Research