My wife has a short list of items that we are not allowed to talk about at the dinner table… one of those items is “tax planning.” While this topic may not be a great or even interesting party conversation, we thought it helpful to review what income tax law changes MIGHT happen in 2021 or 2022.

What Might Change?

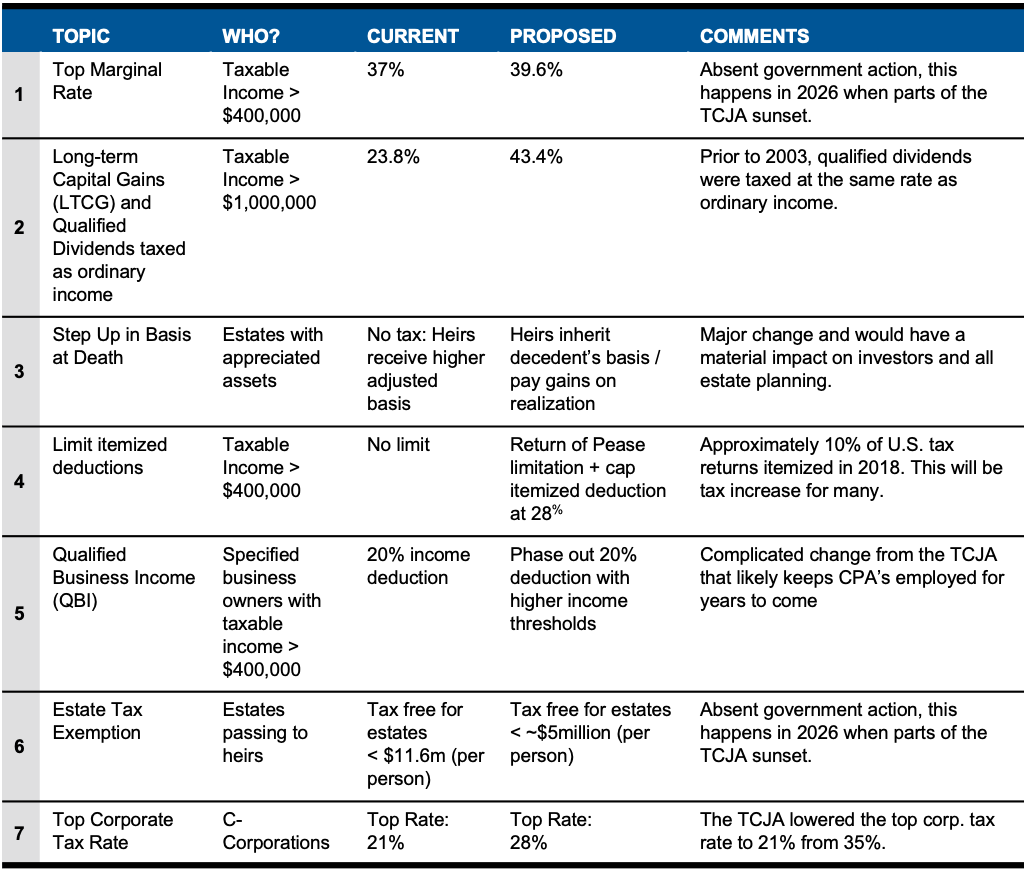

Below is a detailed look at a number of the key items that have been discussed as potential tax law changes.

Source: Russell Investments

Biggest Potential Changes

For individual investors, items #2 and #3 above could possibly have the biggest impact.

Item #2: Consider the impact of an increase of the top tax rate on LTCG/Qualified Dividends from 23.8% to 43.4%. This is an 82% increase and would materially change the way people look at potential investment opportunities.

Item #3: The elimination of the tax-free “step up” in cost basis for investments owned at death would also be a material change. This proposal would prevent an investment to receive a step-up in basis when one spouse passes. The ability to enforce this potential tax law would be very cumbersome as some investors simply do not have the cost basis information from a stock/mutual fund that was purchased 30+ years ago. This proposal affects lower, middle, and upper class Americans.

Timing of Possible Tax Law Changes

Would a 2021 tax code change apply retroactively to income earned in 2021 or would the changes apply to earnings for 2022 (due in April 2023)? Based on prior tax law changes and court rulings, there is nothing that precludes the legislation from being retroactive to the beginning of the year when passed. That means if a tax increase is passed in 2021, the new rates could apply to income earned for the entire year. Given the challenges facing the economy, it’s hard to imagine the new administration passing a tax bill this year and making it retroactive to January 1, 2021. The administration has been clear that their number one goal is the health of the American people. Additionally, the Biden administration has spent very little time talking about tax law change. We are not expecting an income tax increase in 2021, but the Biden administration will most likely look to increase income taxes in 2022.

How To Face This Uncertainty

You NEED a sound investment strategy that focuses on understanding and also mitigating taxes for you and the next generation. Every family is different. Would you like to review the tax efficiency of your investment strategy/wealth plan? Are you wondering how changes today could help reduce taxes in the future? Give us a call… planning is the foundation of what we do, and we are here to help.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children nd the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of Raymond James, we do not provide advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.