Most every serious athlete has a coach. Business leaders have coaches. Even musicians have coaches. Most successful people that are at the top of their profession see the value of objective coaching. In sports, there is a very thin margin between ‘good’ and ‘great’ when competing at a high level and having a coach can make all the difference. If that is the case, why would you try to navigate the complexities of retirement without the assistance of a coach?

I recently read Hank Haney’s book titled The Big Miss. Hank was Tiger Wood’s golf coach for a number of years and the book focuses on Hank’s career while he was coaching Tiger. After finishing the book, I was not convinced that everything in the book was true – I think Hank had an agenda when writing it BUT the book provided a unique perspective on how one should approach coaching someone who is the “best” in his respective field. The book went on to explain that Tiger would at times deviate from good swing mechanics without even knowing it. Hank was able to spot a small problem in Tiger’s swing before it would manifest into a bigger problem down the road.

There is a lot of overlap with how Hank helped Tiger Woods with his golf swing and how we help clients with their retirement planning. People typically come to visit with our team at a “financial crossroad” in their life. They are about to retire, change employers, sell their business, inherit a sum of money from their parents, etc. Our team can counsel and provide fiduciary centric advice to help them spot what might be “small” issues in their planning/investment strategy. Our goal is to find and address those “small” issues before they manifest into something much bigger. Clarity, confidence and comfort are the goals of our fiduciary centric counsel and advice.

What Value Does a Wealth Coach Provide?

Can You Quantify The Value of a Wealth Coach?

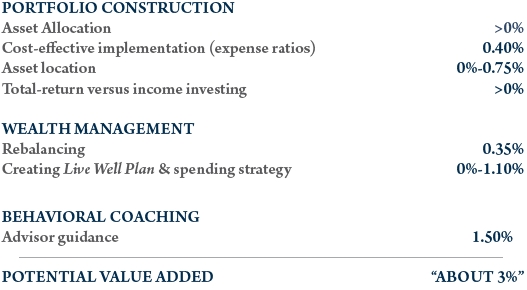

According to a recent Vanguard study, the potential value add of a wealth coach can be about 3% per year.

We are convinced that EVERYONE needs a wealth coach! Our Live Well Plan is the primary tool we use to encourage and enable you to plan for the uncertainties of your financial future.

Want to review your Live Well Plan? Maybe you would like us to help you create a Live Well Plan? Feel free to give us a call at 281-612-3306.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Source: Francis M. Kinniry Jr., Colleen M. Jaconetti, Michael A. DiJoseph, Yan Zilberieng, and Donald G. Bennyhoof, 2016. Putting a Value on your value: Quantifying Vanguard Advisor’s Alpha. Valley Forge, PA: The Vanguard Group. Notes: For “Potential value added,” we did not sum the values because there can be interactions between the strategies. bps = basis points. These hypothetical data do not represent the returns on any particular investment. The projections or other information generated by Vanguard Capital Markets Model® simulations regarding the likelihood of various investment outcomes are hypothetical. Investing involves risk and you may incur a profit or a loss regardless of strategy selected. No investment strategy, including the use of financial professionals, can guarantee your objectives will be met. 3601912.