Thoughts on the Short Term

We recently published our Recession Dashboard which provides a look at the fundamentals of the economy that ultimately drives the stock market higher or lower. It has become much harder to analyze the fundamental data of the economy without focusing on what the government has done and continues to do in support of the economy. Between the Federal Reserve, fiscal policy, and COVID-related restrictions, a very small part (if any at all) of our lives avoid governmental influence.

We believe the short-term forecast for the markets is easier than it has been in the past. Why? Because of the government support in the form of bond buying programs and the many forms of additional government spending will continue to support higher stock/equity values. With that being said, we do not think this precludes us from “normal” stock market pullbacks. The stock market averages a 10% pullback once a year, and a 20% pullback about every 2 to 3 years.

Thoughts on the Long Term

As we look out further (5+ years), forecasting becomes harder. Why? The government has grown in size and in power over the past 18 months. For example, the CDC made decisions last year on what businesses were deemed “essential” and more recently imposed a moratorium on evictions (in violation of property-owners rights). Also, after passing $5 trillion in emergency pandemic spending, the government is considering another $4.5 trillion of spending which will only add fuel to the fire as it pertains to the national debt burden.

Capitalism vs. Socialism

The history of the world has been a battle between two competing ideologies of how resources should be distributed.

Capitalism

This ideology distributes resources through free markets and competition, while attempting to put a system in place to limit fraud and greed. In order to succeed in a capitalist system, you must provide goods or services for which someone else is willing to pay. You have to produce a good or service at a cost less than what you charge the consumer to create wealth. While some people in a capitalist system become extremely wealthy, they do it by creating goods or services that people want and in a way that competitors have a difficult time copying. This system is not perfect, but no human-made system will ever be perfect. With that being said, capitalism has allowed America to become the most prosperous country in the world (and arguably in world history).

Socialism

This ideology allows politicians to distribute resources. Important economic decisions are not left to the markets or decided by individuals. This approach is also referred to as central planning. Advocates of socialism argue that the shared ownership of resources allow for a more equal distribution of goods and services and a fairer society. While this may make sense in theory, the drive to work hard and be productive lessens as your additional output does not result in additional compensation/wealth creation. Government taxes individuals who have been able to create income and wealth at an excessive rate and then transfer those resources to their favored causes or group(s), often while shutting down competition.

Just to be clear, capitalism does not mean zero government. There are many things that governments can do that benefit all citizens without redistributing wealth or income. Examples include public safety, courts, sanitation, and national defense. This government spending can generate huge benefits and is necessary for a free-market system to function in a sustainable fashion. For example, there are very few publically traded companies in Cuba because the government controls which companies receive market share.

Government Debt Affects Economic Growth

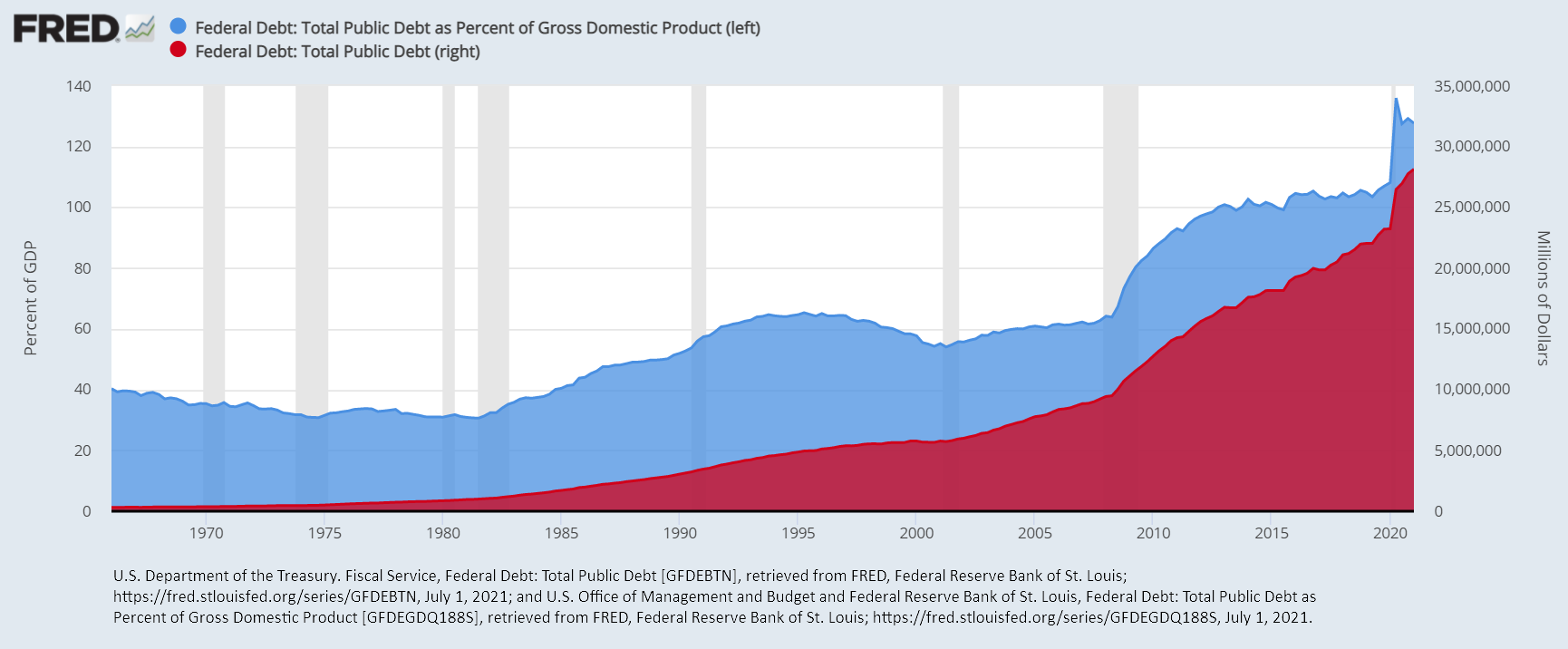

The larger that government debt grows as a relative to the private sector, the harder it is to create more wealth in an economy. According to 2011 research from the Bank of International Settlements, when government debt-to-GDP exceeds 85%, it becomes a drag on economic growth. Earlier this year, the U.S. economic debt was at 127% of GDP.

So far, the U.S. private sector has been able to grow, increase profits, and continue to increase wealth. We believe that is because of the power of entrepreneurs and the new technologies they create. However, this may not always be the case.

What Does This Mean To You?

We continue to believe that income-oriented investments will be vitally important during periods of slower economic expansion. Why? Even if the stock does not move higher, you will still collect the dividend payment. As many of our clients know and understand, we have been focused on companies that not only pay dividends but also attempt to increase those dividends. Looking back at history, dividends have contributed approximately 41% of the total return of the stock market.

Want to learn more? Please feel free to give us a call.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Any opinions are those of The Price Group and not necessarily those of Raymond James. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Dividends are not guaranteed and must be authorized by the company's board of directors. Dividend income statistic sourced from Hartford Funds. 3724383