Introduction

You might read the title of this blog and start yawning. It’s okay – you would not be alone. I like to gauge a client’s interest of a subject based on my wife’s reaction when I ask her about the topic at the dinner table. Needless to say, behavioral finance was not a catalyst to fruitful dinner conversation last week when I broached the subject. That said, this topic is very important to the potential long-term success of our clients (and all investors), so we thought it helpful to explain in greater detail.

What is Behavioral Finance?

Behavioral finance is a relatively new field of study. The theory holds that people often make investment and other money-related based more on emotion than rational, calculated thought. Behavioral finance applies psychological theories to economics and personal finance. As you may imagine, the personal bias and the decisions that people make about their money have a dramatic impact on their personal finances (i.e. their standard of living) and also on the economy.

The Emotions of Investing

“When stocks go up, you never have enough. When stocks go down, you always have too many.”

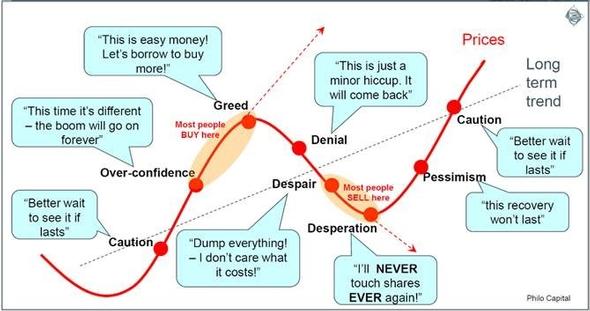

This quote is true with every investor I have ever met. As investors, risk is defined by the change (or deviation) above or below the expected investment return. We have never received a client phone call complaining about the “risk” in their portfolio as markets moved higher. Investors typically care only about risk on the downside. As markets decline, there may be a slow realization that a market falling could be more than just an opportunity to “buy the dip.” As losses mount, investors may become overwhelmed to the point of “averting further losses” by selling. As shown below, this behavioral trend runs counter-intuitive to the “buy low/sell high” investment rule that investors love to quote – they are essentially selling at the point they should be buying!

Why is Behavioral Finance Important?

“I am fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

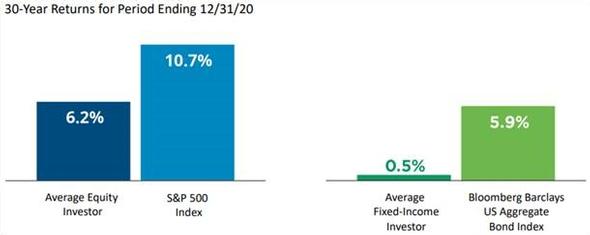

This is a very popular quote, and most investors would say they agree with the logic. But in practice, this is a very difficult idea to implement on a consistent basis. It is similar to me saying, “I want to be healthy.” Everyone wants to be healthy, but few people take the necessary steps to live a consistently healthy life. DALBAR, a leading financial research firm, produces an annual report comparing stock market returns with average investor returns. Their study shows that over the last 30 years (through December 31, 2020), the S&P 500 stock index has produced an average annual return of 10.7%. However, over that same period, the average equity fund investor has earned only 6.2%.

Source: DALBAR’s Annual Quantitative Analysis of Investor Behavior (QAIB), 2020

Bottom line… if we know the tendencies of how investors behave, then we can be more aware of our shortcomings and make a conscious attempt to battle these destructive behaviors and enhance long-term investment performance (i.e. keep clients “on track”).

Key Biases to Keep in Mind

Herd Behavior – Following the crowd is nothing new. There have been many studies on this topic over the past 100 years. As a larger group does something — like buy a “hot” stock or sell in a panic when the market drops — individuals tend to follow. Breaking herd mentality is one of the best things you can do for your finances.

Anchoring – This refers to a tendency to fixate on a particular piece of information while ignoring other information that may be just as relevant to the situation or decision-making process. For example, an investor may anchor on a previous portfolio value and then constantly compare the current value to that previous (usually higher) value. We see this frequently with how retirees look at their former company stock. They say… “Well, I am just going to wait to sell my company stock until it gets back to $90 a share. It was at $90 awhile back.”

Belief in Being “Above Average” – Most people rate their intelligence as “above average.” Studies show that 92% of Americans think they are an “above average” driver – those numbers don’t add up! Most people see success as something that they caused; however, setbacks are blamed on external forces. So, an investor might believe he or she is a stock-picking genius when an investment performs well. But when that investment moves lower, the same person blames the drop in value on “the market” or “the economy.”

Confirmation Bias – We are guilty of confirmation bias when we seek out information that supports what we already believe and ignore facts that are contrary to our belief. Confirmation bias is frequently seen in political arguments. When it comes to investing, confirmation bias can cause us to act without considering all available information. For example, one might want to sell some of their stock allocation due to the current trade tension with China. One would seek out data that agrees with their outlook on the trade dispute.

Loss Aversion – It has been well documented that the pain of a big loss lasts much longer than the excitement from a big win. Some studies have even suggested that losses are twice as powerful, psychologically, as gains. When applied to investments, loss aversion explains an investor’s predisposition to avoid taking losses, even at the expense of sacrificing gains. This unwillingness to accept losses often causes us to hold on to losing investments too long, hoping that someday the investments will bounce back.

Conclusion

There are many behavioral finance concepts that help explain irrational human behavior. Our goal with this post is to help our clients overcome these biases by being aware of them and subsequently adjusting their behavior – the end goal is to invest rationally and achieve better long-term results. As for us, we will remain vigilant and continue to focus on the economic fundamentals rather than letting dramatic headlines distract us from our long-term goals. As always, we are here for you – please call us with any specific questions regarding your Live Well Plan or if we could be of assistance in any way.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

3866649