Kids & Weather

Houston has great weather for 2 to 3 months each year, and after a hot summer, I have found myself looking forward to the fall weather more than normal. Emily was out of town on a girls’ weekend during the first weekend of Fall, and I took Hallie and Harper outside to feel the chilly, 61-degree weather when they woke up. I thought a 4 and 2 year old would appreciate the changing of the seasons. Hallie responded by saying, “Daddy – you talk a lot about the weather.” And it hit me… I am “old” in the eyes of my children! I remember my Grandmother always talking about the weather, and I wondered why she was so interested in the temperature outside of her house.

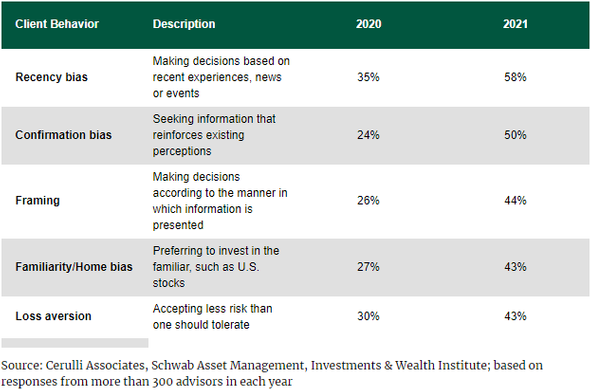

If you have been reading our blogs or Weekly Market Commentary for any length of time, you know we have used the weather as an example for recency bias. For instance, if it has been raining for the last 10 days, we may start to believe that it is going to rain forever! We are all victims of recency bias whether we realize it or not.

An Accelerating Trend

If we look at the statistics, more individuals are using the short-term past as a way to project what will happen in the future. 58% of investors were influenced by recent news, events, or experiences during a recent study by Cerulli Associates. This is compared to 35% of investors the year before!

This begs the question… why is this happening? There are multiple answers to this question, but we believe the top reason is because we now have access to an unlimited amount of information through the internet and social media platforms. We can find information quickly that fits the narrative we want to believe (confirmation bias). In addition to this, the stock market has recently moved higher in an almost straight line. With such success over the past 18 months, stock investors can start to “whisper to themselves” that this is always what happens when you own stocks. A lot of investors have forgotten that over the long term, markets have averaged a 10% pullback once a year and a 20% pullback every 2 to 3 years.

Focus On The Long Term

Knowing our tendencies as investors (and humans in general) can help us combat our natural proclivity towards recency bias. As investors, we need to force ourselves to think in terms of market cycles. Historically, market cycles have lasted for 10 to 15 years. As part of The Price Group’s planning process, we think it wise to solve for an average rate of return over that time period – we call this our Family Index Number. This helps our clients focus on long-term results opposed to short-term market action.

“It’s never as good or bad as you think.”

Many people have used this quote over the years, and I am not sure who deserves the credit, but it is very applicable when thinking about investing over the long term. As the world started to learn about COVID-19 during Spring 2020, the stock market declined about 30% in a very short period of time. We were writing almost daily to clients and friends to keep them updated on our thoughts on the markets and their portfolio. We were adamant that the state of the world was not as bad as the media was leading us to believe. Today, we face a much different challenge. Many investors are expecting the stock market to continue to go straight up. While we continue to be cautiously optimistic, we are urging clients and other readers to mentally prepare for a market pullback. Why? Because history typically does not repeat itself, but it often rhymes.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

3878294