Are Stocks Expensive?

This is a great question and a topic we discuss with clients on an almost daily basis. It is difficult to give an absolute answer to this question because there are so many different variables at play. Let’s discuss a few key components of valuation to better understand this topic.

Earnings Per Share (EPS)

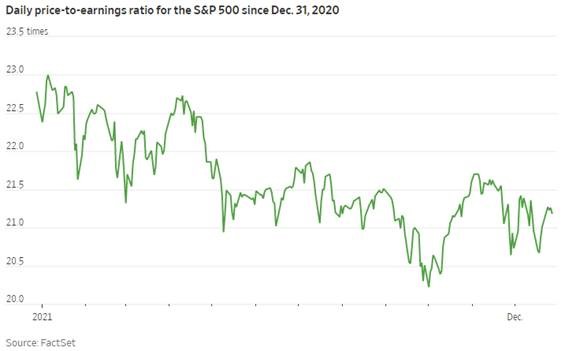

Earnings per share (EPS) is one metric that can be used to partially understand if the stock market is “expensive.” This metric calculates the earnings of the companies in the S&P 500 as a percentage of their total value. Since the S&P 500 rose approximately 27% in 2021, you might think that stocks are expensive. However, when looking at EPS, stocks are cheaper than they were at the beginning of 2021. How? Earnings grew more than the stock prices themselves.

Relationship Between Interest Rates & Stocks

Stocks do not stand alone in the financial universe, but rather compete with other assets—specifically bonds. The higher the bond interest rate, the more attractive the bond is compared with stocks. Therefore, for an investor, there is a direct relationship between interest rates and stock prices.

Over time, the stock market has returned around 8-9% per year. If you could invest in a “risk-free” U.S. Treasury bill/bond giving you the same rate of return, wouldn’t you forgo the stock market and buy that bill/bond instead? Why take the risk involved with stocks if you don’t have to? When interest rates are low (i.e. current period), stocks are more attractive. Why would you want to own a 10-year U.S. government bond yielding 1.7% when you can own a collection of dividend-paying stocks paying over 2%? When interest rates go down, you would expect stock prices to move higher, and recently, this relationship is what we have seen.

We expect longer-term interest rates (i.e. 10 year U.S. bond) to move higher over the next 12 months but not to the point where stocks become unattractive.

Stock Market Pullbacks

Even though we are bullish on stocks for 2022, this does not preclude us from the probability of a stock market pullback/correction. On average, the stock market has a 10% pullback (or correction) once a year and a 20% pullback every 2 to 3 years. This is very healthy and “normal” and should be expected during bull markets.

Bottom Line

Stocks will continue to do well if companies can continue to grow their earnings. We think this trend of earnings growth continues for 2022 but at a more subdued level compared to 2021. Thus, the importance of dividend stocks and also the critical need for a repeatable investment strategy.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of The Price Group and not necessarily those of Raymond James. 4097574