We have all crossed paths with someone who is a “know-it-all”. Maybe a friend, an extended family member, or that person in your office who sits down the hall from you. You can never break any new news to that person because they already heard about it. They already have the “right” answer for every situation and are never looking for feedback. That person is usually on a crusade to make sure that the people around him (or her) understand how smart they really are. Sometimes it is best to spend time with these people in small doses.

With the goal of being an antithesis of the proverbial “know-it-all”, we need to confess something… we do NOT know what is going to happen in the markets over the next 12 months. Not many professionals in our industry like to admit this but spoiler alert… nobody else knows either. We do not know how high interest rates go. We do not know if the Ukraine/Russia conflict spreads into other European countries. We just do not know. Warren Buffett has a famous saying “neither I nor you are smart enough to predict what will happen to the stock market within a year from now.” We agree with Mr. Buffett.

And it is okay that we do not know. Why? Because we are finite creatures who cannot tell the future. But this begs the question... if we do not know what the future holds, how can we do a good job managing our trusted clients’ hard earned money? We answer that question with the reminder that it is critical to have and follow a time tested and repeatable investment process.

Let’s review a few foundational concepts for a respectable investment process:

1. Long-term perspective

Making investment decisions with a short-term mindset can be a guessing game. We are investing our client portfolios with a long-term mindset. We do not believe that the stock market’s long-term trajectory is going to be drastically thrown off course by consistent short-term “noise.” However, the unknowns are always the “news of the day” and will often lead to volatility and perhaps lower stock prices in the SHORT-TERM.

2. Timing the market is a fools game

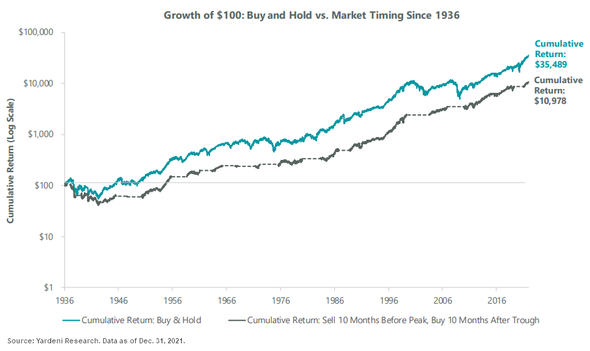

Since 1936, an investor that consistently sold their stocks 10 months prior to a market peak and bought back in 10 months after the “low” of the market was worse off overall than a “buy-and-hold” investor. Trying to time the market on a reoccurring basis is like playing roulette at the casino in Vegas… the house is going to win a majority of the time.

3. Utilizing a comprehensive wealth management plan

We call our holistic wealth management plan a Live Well Plan because we are a little bit cheesy but primarily because our ultimate goal is for you is to worry less and live well. Our fiduciary centric planning process is far superior to any retirement spreadsheet in that we forecast years of negative performance to more accurately predict your probability of success in retirement. Our Live Well Plan calculates different sequence of investment returns 1,000 times to provide the most accurate probability of success. Our end goal with our planning process is to give you clarity, comfort, and confidence to worry less and enjoy life more.

The Price Group is Here For You

Randy and I understand that stock market volatility can be worrisome. We want to make sure you know we are here to assist you in every way possible. We are not always right, but we always have a reason and a repeatable process for the investment decisions we make.

To that end, please call us with your questions or concerns at (281) 612-3304. We pride ourselves on personal, one-on-one service to help our valued clients live well. We want you to be confident that when markets are volatile - we've got you covered.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Any opinions are those of Matt Price and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance does not guarantee future results. Keep in mind that individuals cannot invest directly in any index. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. 4551129