Here at The Price Group, we are not trying to be all things to all people. Our niche has been and will continue to be retirement planning. Our team has been humbled to help our 300+ families plan for and walk through the complexities of retirement. Our promise to current clients is that we will NOT grow our business unless we can continue to offer the same high-end personal service that each client family has become used to expecting.

When we meet a new family who is “kicking the tires” to hire a financial advisor, we often get asked the question… “how are we able to quantify the value that a financial advisor may provide?” This is a very good question and worthy of explanation.

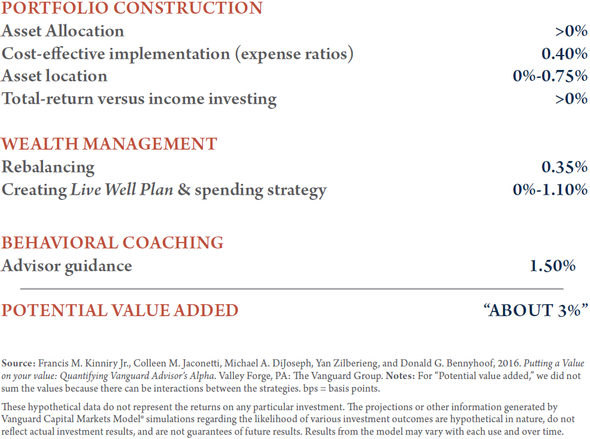

Vanguard first published a research report on the valued added by a competent financial advisor in 2014. They continue to update their research every few years. Their research suggests that a competent advisor can add approximately 3% in annual returns each year.

Let’s explore a few of these topics in more detail:

Behavioral Coaching

Providing discipline and guidance could be the largest value-add you receive from a financial advisor. Because investing can naturally evoke emotions that facilitate short-term thinking, a financial advisor can help you maintain a long-term perspective and a disciplined approach with your personal finances. This coaching can be the most valuable during periods of negative performance. Here at The Price Group, we help clients avoid making long-term decisions based on short-term volatility. The closer you get to retirement, the more important behavioral coaching becomes.

Creating a Live Well Plan & Spending Strategy

Creating a holistic financial plan (we call ours a Live Well Plan) is the best way to create your financial goals and stick to the “game plan” when markets can throw us temporarily off-course. Our Live Well Plan encompasses and coordinates ALL areas of your personal finances. The Live Well Plan includes cash flow projections and allows us to test adjustments in real time and predict your retirement readiness.

An appropriate withdrawal rate can make an enormous difference in the longevity of your savings. Figuring out which accounts to withdraw from and when to withdraw funds is an annual task and can get complicated. Here at The Price Group, we help you develop a strategy to reduce the total income taxes you will pay over the course of your retirement.

Asset Allocation

Before making a recommendation for your asset allocation, we believe you need to develop a Family Index Number. Our Family Index Number will help us determine how much risk you NEED to take in retirement to be successful. Unless you tell us otherwise, our goal is to take the least amount of investment risk necessary… this is because we want your probability of retirement success to be as high as possible. Once this is complete, we are prepared to develop and recommend the most appropriate asset allocation (mix of stocks vs bonds).

Cost-Effective Investments

Whether you are managing your own investments or working with an advisor, investment costs are a fact of life… Put simply, when you pay less, you keep more. However, research continues to suggest that the additional costs from engaging a financial advisor could add considerable value and also provide peace of mind over the long run. In addition to providing a customized financial plan to help you work toward your goals, the advisors with The Price Group are mindful of lower transaction costs, expense ratios and custody fees when making investment recommendations.

One example of cost-effective investing at The Price Group is our belief in the ownership of individual stocks. If you own the individual stock, you essentially eliminate the “middle man” (i.e. mutual fund or ETF expenses) and save some dollars along the way. Here at The Price Group, the vast majority of securities owned by our clients are individual stocks.

Rebalancing

Once you’ve selected an asset allocation strategy to reach your retirement goals, it’s important to maintain that allocation. This is much easier said than done. For example, we rebalanced many discretionary client portfolios back in the spring of 2020. As many of you remember, the S&P 500 had dropped approximately 30% in just a few months. This caused most clients to be “light” on their stock allocation. Because of this, we added to stocks and reduced some of our cash and/or fixed income when the market was down. This never feels good in the moment but this is an important aspect to being a successful long-term investor.

You are Unique. Your Financial Plan should be too.

Here at The Price Group, we do not have a cookie cutter approach to your financial and investment planning. Your financial situation is unique, and not all of our planning and investment strategies make sense for every client. Your personalized Live Well Plan begins with personal goals, dreams for the future, accounts for the progress you have made, and continues to help you navigate the complexities of retirement. Our continuing goal is to provide comfort, confidence, and clarity about your financial future.

If you would like to discuss your specific situation and how you may benefit from working with a fiduciary-centric wealth advisor, please reach out to our team.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Asset Allocation does not assure a profit or protect against loss in declining financial markets.

Rebalancing does not protect against a loss in declining financial markets. There may be a potential tax implication with a rebalancing strategy. Investors should consult with their tax advisor before implementing such a strategy.

Matt and Randy Price are Wealth Managers with Steward Partners participating in the Steward Partners Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Wealth Manager invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Steward Partners ADV Part 2, available athttps://adviserinfo.sec.gov/Firm/283004 or from your Wealth Manager.

Steward Partners Investment Advisors offers a wide array and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please consult with your Wealth Manager to understand these differences. Please visit us at https://adviserinfo.sec.gov/Firm/283004 or consult with your Wealth Manager to understand these differences

AdTrax 4766787.39 Exp 1/25