Augusta National Golf Club hosts the most famous golf tournament in the world each year called The Masters. With the 2023 tournament quickly approaching, Randy, Matty, and I could not be more excited.

One could argue that we witnessed the greatest sports comeback of all-time back in 2019 at The Masters. Arguably the best to have every played the game, Tiger Woods returned to professional golf in 2017 after four back surgeries, a knee surgery, and a handful of other personal/physical impediments. As he limped down fairways and with pundits questioning if he would ever win again, Tiger prevailed at the 2019 Masters – 22 years after his first green jacket in 1997. Jim Nantz was quoted as saying the 2019 Masters was “the best event I’ve ever covered,” and Mr. Nantz has had a front row seat to decades of high caliber sporting events. While we could spend hours discussing Tiger’s comeback, we wanted to spend some time discussing the potential municipal bond comeback.

Historic Performance of Municipal Bonds

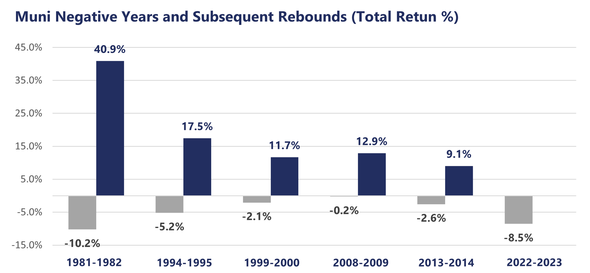

Municipal bonds rarely deliver negative performance for an entire calendar year. It has only happened six times over the last 42 years. Unfortunately, 2022 was one of those negative years. Because of this, we thought it helpful to study the subsequent returns for municipal bonds after each of these six years of negative performance.

Source: Source: New York Life Investments, Bloomberg, Bloomberg Municipal Bond Index Total Return Index Value Unhedged USD.

While past performance does not guarantee future results, you can see that every negative year in the municipal bond market has been followed by a positive return.

Attractive Yields

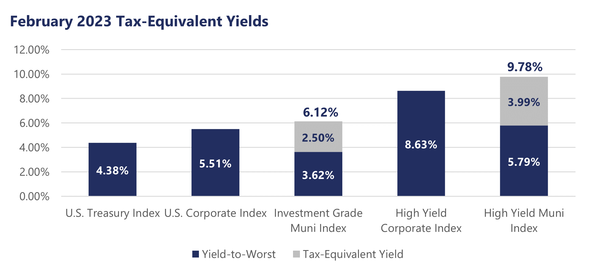

While municipals bond yields depend greatly on the length of the bond and the credit of the municipality, we believe municipal bonds continue to offer great value compared to taxable equivalent bonds.

Source: New York Life Investments, Bloomberg, as of 02/28/23. Representative indices: Bloomberg U.S. Treasury Index, Bloomberg U.S. Corporate Bond Index, Bloomberg U.S. Municipal Index, Bloomberg U.S. High Yield Corporate Index, and Bloomberg High Yield Municipal Index. Assumes 37% federal tax rate and 3.8% net investment income tax. Yield to worst is computed by using the lower of either the yield to maturity or the yield to call on every possible call date.

Moving Forward

Here at The Price Group, we continue to be comfortable with the municipal bond market on a selective basis. According to the Wall Street Journal, about 40% of the municipal bond market is owned by retail investors (opposed to institutional investors) which causes the market to be a little more choppy, but this is the price you pay to produce tax-free income. We expect that new issuance for the municipal bond market will be lower this year because interest rates are higher and borrowing money is more expensive for municipalities. If this holds true, the tax-free bond market will have some “wind at its back” due to limited supply which could drive bond prices higher. Obviously, the great unknown is where interest rates go from here.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

For index definitions click here.

Interest on municipal bonds is generally exempt from federal income tax. However, some bonds may be subject to the alternative minimum tax (AMT). Typically, state tax-exemption applies if securities are issued within one’s state of residence and, local tax-exemption typically applies if securities are issued within one’s city of residence. The tax exempt status of municipal securities may be changed by legislative process, which could affect their value and marketability.

A taxable equivalent yield is only one of many factors that should be considered when making an investment decision. Steward Partners and its Wealth Managers do not offer tax advice; investors should consult their tax advisors before making any tax-related investment decisions.

AdTrax 4766787.55 Exp 4/24