Expectations Are A Big Deal

Being efficient on a road trip is important to me… I don’t know why but it always has been. I almost never speed when driving within the city but I feel like I should always be going 10+ MPH over the speed limit if I am on a long road trip. My rationale is if I can get 10 more miles an hour on a 10 hour road trip then I get 100 extra miles in the same time… said another way, you save 1 – 2 hours on a long trip on this distance. And in some spots in west Texas, the speed limit is 85 MPH so is it really speeding if on the same highway at a different mile marker?

With that as a backdrop, I had an expectation that my wife (Emily) would share my affinity for being an efficient road trip warrior after having kids. Boy – I was wrong! We took our first road trip as parents when Hallie (our first born) was 9 months old. Our family trip was to 30A (a beach outside of Destin, FL). I thought I could still do the 10 hour drive in less than 10 hours. To my surprise, this ended up being a 13 hour drive due to all the stops needed to eat, use the restroom, and change diapers. During our week at the beach, I make a conscience decision to reset my expectations. My expectations went from trying to be efficient to enjoying the time with our family leaving a little earlier to allow time for extra stops.

Expectations For Stock Market Returns

In a similar fashion, we think an important part of our job as a holistic wealth advisor is to help our clients set realistic expectations for future investment returns. We want to replace the complexity with clarity by creating a Live Well Plan and defining a Family Index Number for each family that we serve. Once this is complete, we use several macro-economic indicators to estimate the future rate of return for the stock allocation of an investment portfolio.

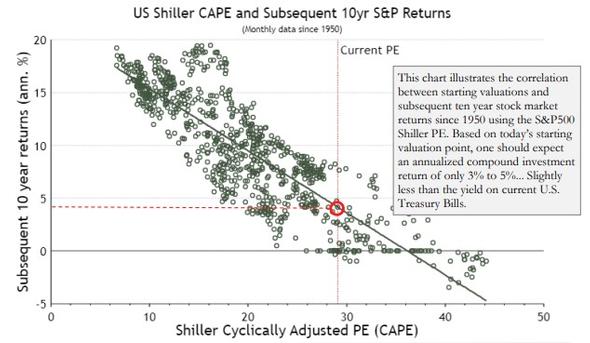

Below is a look at one of the indicators we study on a consistent basis… this chart uses the adjusted price/earnings levels to estimate stock market returns over the next 10 years. As you can see, the “expected” stock market return using this one data point is about 4% - 5% per year over the next decade. While this estimated return is less than the long-term average of stocks, it make sense when we realize that the past 15 years have produced returns higher than the long-term average. This can be referred to as a “reversion to the mean.”

Source: Robert Shiller, FactSet

How To Invest In This Environment?

If future stock market returns are more muted over the next decade compared to the past 10 – 15 years, one could make a fairly compelling argument that dividend stocks make more sense than growth stocks. This is logical as you are still able to collect the dividends paid by the company even if the stock price does not move higher. This concept is a foundational principle of The Price Group’s investment process. We continue to focus on companies that not only pay dividends but have historically had a propensity of increasing their dividends year over year.

While this information is helpful and somewhat interesting, another major contributor to stock market returns has to do with the current level of interest rates. To over-simplify a complex topic, one could say that lower interest rates make stocks as a whole more valuable. If inflation and interest rates continue to move lower as they have over the past 6 months, this should provide a “tail wind” for stocks moving forward.

About the Author

Matt Price serves as a Partner and Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 11 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The strategies and/or investments discussed in this material may not be appropriate for all investors. Steward Partners recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a Wealth Manager. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease or totally eliminate their dividends without notice.

AdTrax 4766787.56 Exp 4/24