Growing up, I remember thinking at times that my parents were trying to keep me from having fun. They did not let me stay out past 11:30 pm when I was in high school. They made me eat my dinner before dessert when I was a little kid. They made me brush my teeth and floss every night. They forced me to play outside every day and read books instead of just watching TV. And the list goes on.

Sometimes as parents, we have to make unpopular decisions with our children for their own good. I now understand this a lot more with four kids of my own.

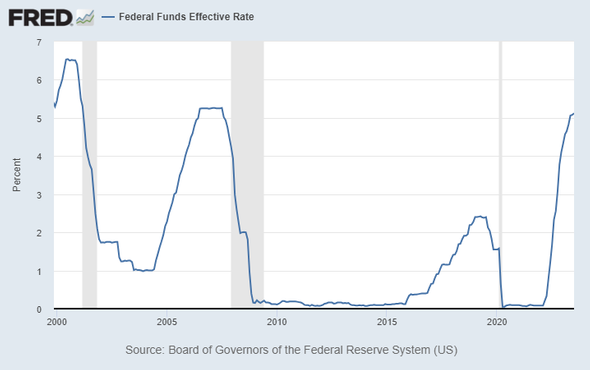

In a similar fashion, the Federal Reserve (who sets interest rate policy and monetary policy) also has to make unpopular decisions at times. Below is a look back at how restrictive (or accommodative) the Federal Reserve has been dating back to 2000. As many of you know, higher short-term interest rates are considered restrictive monetary policy as it is more costly to borrow money for future growth. Lower interest rates are considered more accommodative for economic growth.

As you can see, the Fed went from an accommodative stance in 2020 because of the pandemic (by setting interest rates near 0%) and has quickly reversed course, becoming much more restrictive. But has the Fed become too restrictive? Will their policies force us into a recession? Time will tell!

We have written (and said to many of you) this year that we expect a mild recession toward the end of 2023 or the first half of 2024. While no one can know the exact timing, we do NOT think this will be a deep recession like we experienced in 2008/2009 or in 2020. We are of the opinion that the market as a whole has priced in a mild recession. As many of you remember, the stock market typically “bottoms” 3 to 6 months before the deepest part of the recession.

Bottom line is this… a bonified investment process that is predicated on producing income for retired investors should not be thrown off course because of a mild recession. Do we need to know what we own? Yes. Will we have recommended changes at some point in the future? Of course. With that being said, we continue to be confident that income generation is one of the key ingredients to success in retirement regardless of Federal Reserve policy.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

AdTrax 4766787.84 Exp 9/25