According to Merriam-Webster, a dividend is “a share in profits to stockholders.” Said another way, a dividend is a payment to a shareholder of a portion of a company’s profit. But how big of a portion? Some companies with plenty of profits do not even pay a dividend. Other companies at times will pay a dividend that exceeds their profit.

Randy and I have always believed that the dividend policy of a company says a lot about how the company treats their owners (shareholders). Some companies decide to keep their earnings and reinvest them in the business. In our view, these companies tend to have greater opportunity for growth. While this can make sense for some companies and investors, we are more drawn to dividend paying stocks… especially for those who are approaching retirement or are currently retired.

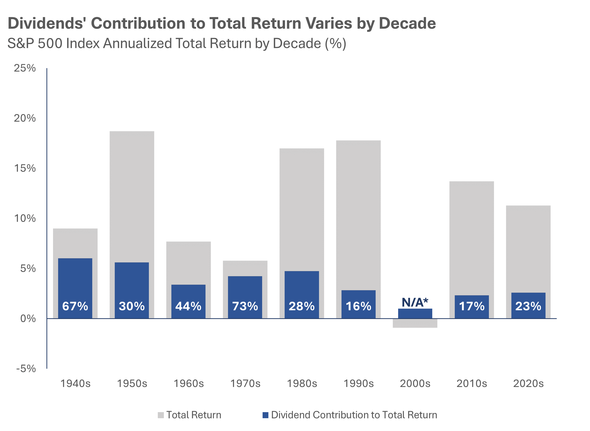

Dividends can be quite impactful on total return. While dividends’ contribution to total return varies decade-by-decade, dividend income has accounted for approximately 41% of total return dating back to WWII.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. * Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade. For illustrative purposes only. Source: Hartford Funds, 12/22.

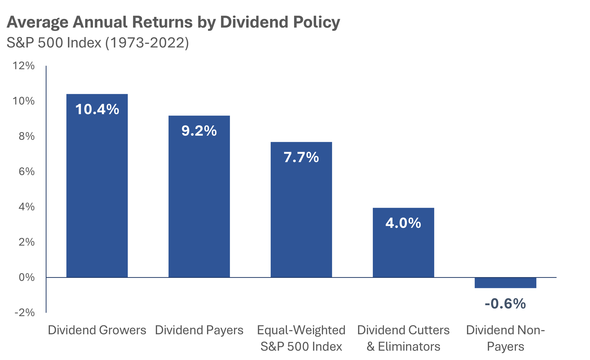

There are a few camps of dividend stock investors out there. Some primarily seek high dividend income from the companies they own. Others primarily desire that their dividends grow each year. While we like high dividend income, we gravitate towards prioritizing the growth of dividends. What we have found is that if a company can increase the dividend to an investor, the value of that company is likely to grow… this is not just the opinion of The Price Group but backed up by historical evidence as you can see below.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Sources: Hartford Funds, 12/22.

We believe that our process of identifying dividend paying stocks that are able to grow their dividend over time may produce a more consistent, less “bumpy” ride for your investment portfolio. Less volatility means that investors are more likely to stay invested even during volatile times. While some may enjoy the excitement of being the hare, we all know that the tortoise wins the race.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease, or totally eliminate their dividends without notice.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

The Standard and Poor's 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The Standard and Poor's 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

AdTrax 4766787.83 Exp 9/25