My wife (Emily) and I are both the oldest of five kids. This creates a loud/fun atmosphere most of the time but it also creates a lot of sibling weddings to attend. Over the past weekend, the LAST sibling on both sides of each family got married… one of my brothers married a sweet girl from Fort Worth. Over the past 20 months, we have had 5 sibling weddings where our two daughters were flower girls in each ceremony! While we are elated for our sibling to get married, we are also excited that this season has come to a close. Traveling as a family of 6 to a destination wedding is not for the faint of heart.

In a similar fashion, the markets should be experiencing a changing of season which would be a welcomed change from the negative volatility we have experience over the last 4 – 6 weeks… the S&P 500 was down approximately 3.3% over the past 3 months (Source: FactSet). Downside equity market volatility can be unsettling, but it is important to put the pullback in perspective and identify the drivers of the negative market reaction. We have provided a brief update on the five most pertinent topics affecting the market(s) below:

Economy | We have not changed our call for a mild recession in the first half of 2024—driven by slowing job growth, depleted excess savings and the lagged impact of higher borrowing costs. However, we expect this to be a MILD recession (both in time and magnitude of the economic contraction) where corporate earnings should remain resilient.

Federal Reserve | The Fed is in the late innings of its tightening cycle, with possibly one more rate hike this year before ultimately cutting interest rates in the back-half of 2024. The important point is that, historically, the S&P 500 rallies after the last Fed rate hike (Source: Raymond James).

Interest Rates | Yes, the 10-year Treasury yield has risen to ~4.65%, but our expectation is that it will not stay there long. We expect long-term interest rates to fall toward 3.5% over the next 12 months. Recessionary concerns, decelerating inflation and the Fed ending its tightening cycle should help move interest rates lower. This will be significant as higher interest rates are likely the main culprit behind the recent stock market pullback. Said another way….assuming that interest rates fall, we think the stock market will move higher.

Inflation | We expect inflation to continue to trend lower over the next several quarters. Yes, the ‘headline’ inflation trend has risen due to higher energy prices. We expect core prices to continue on a disinflationary path even if headline inflation moves higher. A continuation of shelter/rent prices decelerating should contribute to the downward trend. Reduced inflation should drive interest rates lower and take pressure off the Fed.

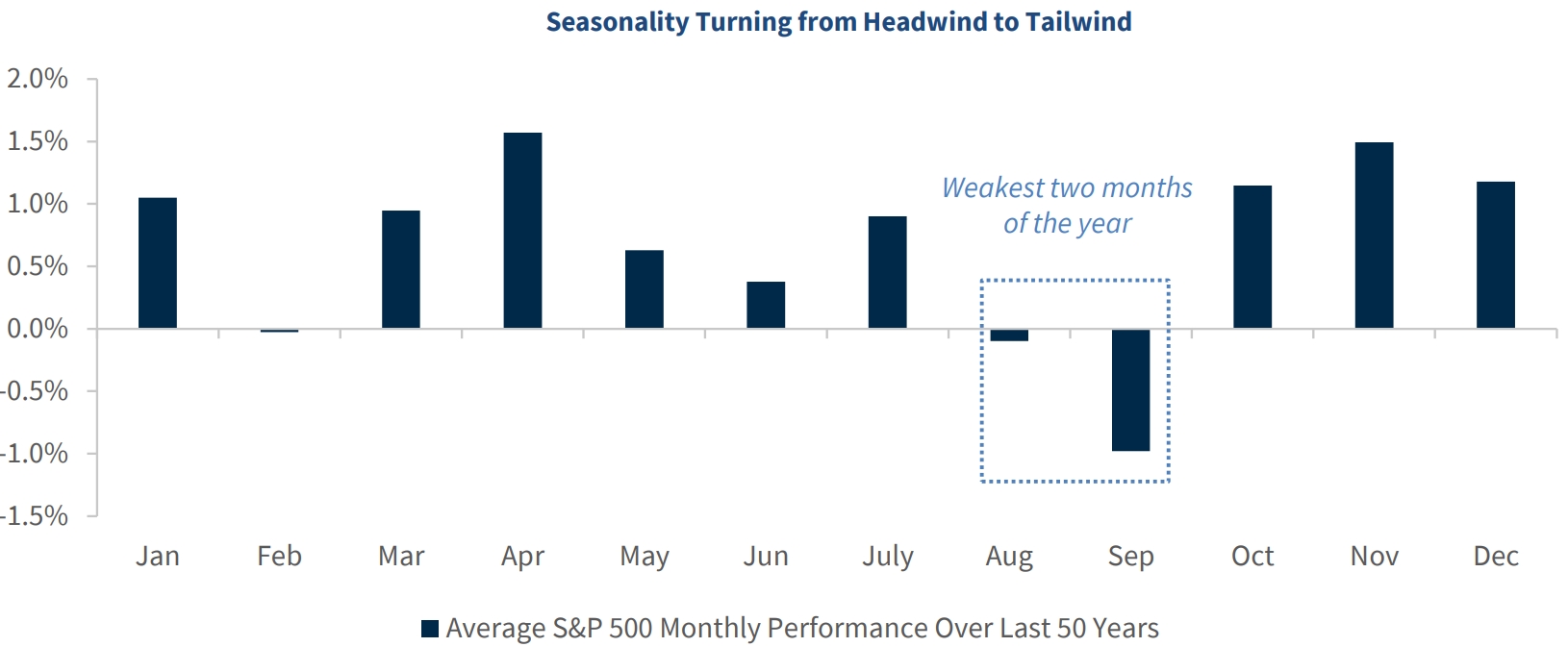

Changing Seasonality | The negative seasonality pattern of August and September should turn more favorable as we enter the last three months of the year. Historically, mid-October through the end of the year has been strong. This is sometimes referred to as the “Santa Clause rally.” In addition, it does appear the market is oversold which is typically a positive sign for future returns.

Source: FactSet, as of 9/26/23

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease, or totally eliminate their dividends without notice.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

The Standard and Poor's 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The Standard and Poor's 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

AdTrax 4766787.90 Exp 12/23