It has been a strange world for bond investors over the past few years. I remember selling a Dallas water bond for a client back in the summer of 2020 as interest rates were at all-time lows. We discussed the possibility that interest rates could move higher causing bond prices to move lower. The client made a good point that interest rates have been moving lower since the 1980’s… and he was right! Not many people (including ourselves) expected interest rates to move this high in such a short period of time. Given this historic volatility within the bond market, we thought it helpful to provide a detailed explanation of our thoughts related to interest rates and cash/money market yields. If you do not desire a detailed explanation but would rather only an executive overview, we have also included a three-sentence summary below.

Executive Summary

We are of the opinion that we are in the “last innings” of interest rates moving higher. We do NOT believe that now is the time to abandon your bond holdings. Historically, cash/money market yields have underperformed corporate bonds, core bonds, and municipal bonds once interest rates peak.

How We Got Here

The amount of money created by the Federal Government during the 2020 pandemic period is the culprit for current inflation and the higher interest rates.

In 2008/2009, the Federal Reserve had a dramatic shift in monetary policy where they made money more accommodative in an attempt to spur the economy towards growth. The same tactic was used in 2020 but federal spending was MUCH higher in 2020 when compared to the 2008/2009 time period.

If you are interested in learning more about how the federal spending/monetary policy is responsible for inflation, let us know. We can steer you towards some helpful research that discusses this topic in more detail.

2023 Thought Process On Taxable Bonds

Earlier this spring, we made the decision that interest rates had risen "a lot" by historical standards and we would see a “leveling off” of interest rates. Because of this, we sold some of our junk bonds (higher yielding bonds) in portfolios that we manage and purchased more investment grade (higher quality bonds). During this same time frame, we also recommended an increase in an institutional money market (i.e. cash alternative) along with some short-term bonds.

While hindsight is always 20/20 when investing, it is human nature to sometimes second guess your investment decisions. Looking back on these changes made earlier this year, we have a few additional thoughts:

- We still like the idea of having investment grade (higher quality) bonds in the portfolio with the likelihood that the U.S. economy heads toward a recession within the next 6 to 9 months. The junk bonds (higher yielding bonds) tend to underperform during a recession. As we have written about many times this year, we are of the belief that the expected potential recession to be mild in nature. We wish we would have waited until now (Fall 2023) to move toward more quality bonds as it looks like we were “early” with this change. But once again… hindsight is always 20/20.

- We are glad we added to our money market (cash alternative) and our short-term bond position when we did. Money market yields have had a good return this year relative to the overall bond market (Source: FactSet). We currently have approximately 28% invested in these short-term instruments which has allowed our portfolio to “hide” from some (not all) of the bond market volatility we have seen this year.

- For some clients, we have continued to add to our private credit fixed income allocation.

Moving Forward

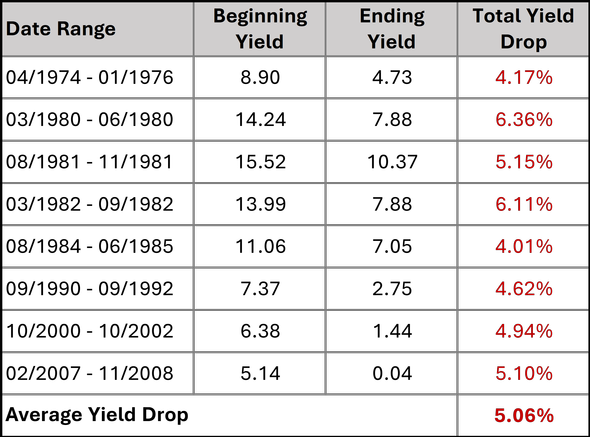

Moving forward, we do not think cash money market will be a superior long-term investment. We are in the process of deciding how much of these short-term holdings to invest. Current interest rates for bonds have reached a place that we believe bonds are a compelling value. Below is a look at how quickly cash/money market rates can drop. As you can see, the average drop has been approximately 5% over a 2-year time frame.

Data Source: FactSet, 9/23

The Federal Reserve (Fed) might increase short term interest rates one last time. Other analysts disagree and believe the Fed is finished raising short-term interest rates. Time will tell, but we do think we are in the “last innings” of interest rates moving higher.

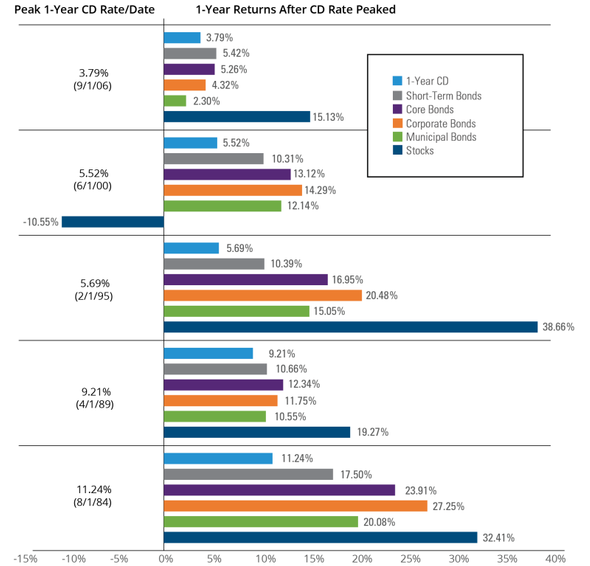

We do NOT believe that now is the time to abandon your bond holdings. Historically, cash/money market yields have underperformed corporate bonds, core bonds, and municipal bonds once interest rates peak (see below).

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. CD rates based on previous peaks in national average rates. See back page for representative index definitions. Source: Hartford Funds, Morningstar, 8/23.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

This material does not provide individually tailored investment reccomendations. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The strategies and/ investments discussed in this material may not be appropriate for all investors. Steward Partners recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the help of a Wealth Manager. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Bonds are subject to interest rate risk. When interest rates rise, bond prices fall; generally the longer a bond's maturity, the more sensitive it is to this risk. Bonds may also be subject to call risk, which is the risk that the issuer will redeem the debt at its option, fully or partially, before the scheduled maturity date. The market value of debt instruments may fluctuate, and proceeds from sales prior to maturity may be more or less than the amount originally invested or the maturity value due to changes in market conditions or changes in the credit quality of the issuer. Bonds are subject to the credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and or interest payments from a given investment may be reinvested at a lower interest rate.

Bonds rated below investment grade may have speculative characteristics and present significant risks beyond those of other securities, including greater credit risk and price volatility in the secondary market. Investors should be careful to consider these risks alongside their individual circumstances, objectives and risk tolerance before investing in high-yield bonds. High yield bonds should comprise only a limited portion of a balanced portfolio.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

Mutual funds are sold by prospectus. Investors should carefully consider the investment objectives and risks as well as charges and expenses of mutual funds including the underlying portfolios before investing. To obtain a prospectus, contact your Wealth Manager. The prospectus contains this and other information about the investment. Read the prospectus carefully before investing.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Securities and investment advisory services offered through Steward Partners Investment Solutions, LLC, registered broker/dealer, member FINRA/SIPC, and SEC registered investment adviser. Investment Advisory Services may also be offered through Steward Partners Investment Advisory, LLC, an SEC registered investment adviser. Steward Partners Investment Solutions, LLC, Steward Partners Investment Advisory, LLC, and Steward Partners Global Advisory, LLC are affiliates and separately operated. The Price Group is a team at Steward Partners.

Please do not use e-mail for requests to buy or sell a security as they cannot be honored. If you have received this communication in error, please notify the sender immediately. Steward Partners reserves the right, to the extent required and/or permitted by applicable law, to archive and monitor all electronic communications (including, but not limited to, emails, instant messages, text messages and social media posts), and reproduce electronic communications to state, federal or other regulatory agencies.

Securities, insurance products and investment advisory services are: • NOT FDIC Insured • NOT Bank Guaranteed • and MAY Go Down In Value.

AdTrax 4766787.94 Exp 12/23