KISS stands for “Keep it simple, stupid”. Have you heard this acronym? It is something you might share with a friend when he or she is overthinking a situation. Maybe a kinder way to communicate a similar point would be to say… “let’s take another look back to see the forest as opposed to just a few trees.” Either way, these sayings can encourage us to take a step back and look at the bigger picture.

All humans are linear thinkers. We are prone to extrapolate the most recent past into the future. For example, after hurricane Harvey, most Houstonians were convinced that it was going to rain forever. This phenomenon can also be true with investing. When markets move lower (and they inevitably will), some investors will begin to believe that stock prices will continue to never move higher.

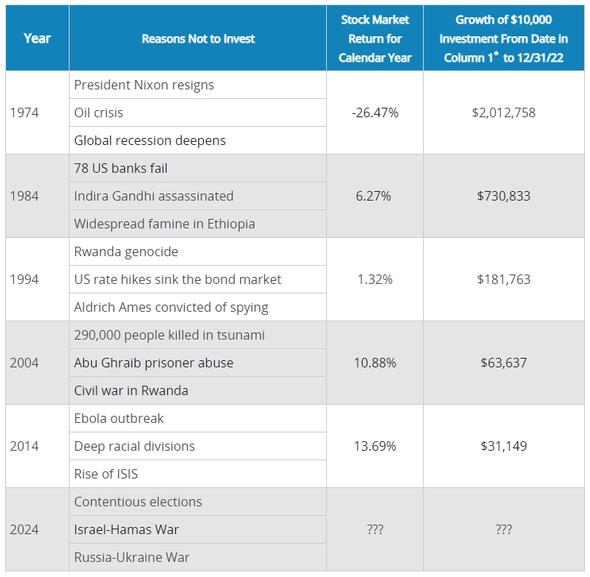

As you can see below, history does not support this notion as markets have always rebounded from a market correction.

Past performance does not guarantee future results. *Assumes an initial investment of $10,000 in stocks beginning on January 1 of the date in column 1 through December 31, 2023, reinvestment of dividends and capital gains, and no taxes or transaction costs. Stocks are represented by the S&P 500 Index, which is a market capitalization-weighted price index composed of 500 widely held common stocks. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data Sources: Morningstar and Hartford Funds, 1/24.

However, 2024 is not a year without concern. This will arguably be the largest global election year in history coupled with geopolitical tension in the Middle East, and problems regarding the U.S. border. Despite these concerns, we encourage our clients who are long-term investors (not short-term traders) to take a step back to more clearly see the bigger picture. What does it mean to “see the bigger picture?” Let’s use our most recent conversation with Sally to help answer that question.

Last month, we had a prospective client (we will call her Sally for sake of privacy) express a concern that she knows markets will rebound but she is planning to retire later this year and does not feel like she has time to wait for the market to recover.

Sally makes a great point. Market recoveries do take time. Here are two items that we encouraged Sally to consider about her specific situation:

We could make the argument that 2024 is a type of macro environment where it is even MORE important to know what you own in your investment portfolio and additionally why you own it. Our investment process is centered around owning well-established companies that pay dividends and have consistently increased those dividends each year.

Interested in diving into the details or reviewing the “bigger picture” of your retirement? The Price Group is here to help.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The strategies and/or investments discussed in this material may not be appropriate for all investors. Steward Partners recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a Wealth Manager. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

AdTrax 4766787.116 Exp 2/25