Retirement savings are not built overnight… they are usually built slowly by living within your means, saving on a regular/consistent basis, and investing based on your financial goals over a long period of time. But retiring at the wrong time may deplete portfolios much faster than expected. This risk is referred to as sequence of return risk. We will provide a brief overview of sequence of returns, an example, and several strategies that can be used to help guard against it.

Why Sequence of Return Risk Matters

Sequence of return risk refers to the threat posed by experiencing poor investment returns early in retirement. Having poor returns in your first few years of retirement may seriously reduce the longevity of your retirement portfolio. Under certain scenarios, retirees might be forced to spend less during their ‘golden years’ and sometimes outlive their retirement savings. Needless to say, it’s important to address sequence of returns risk prior to your retirement.

Same Returns But In A Different Order

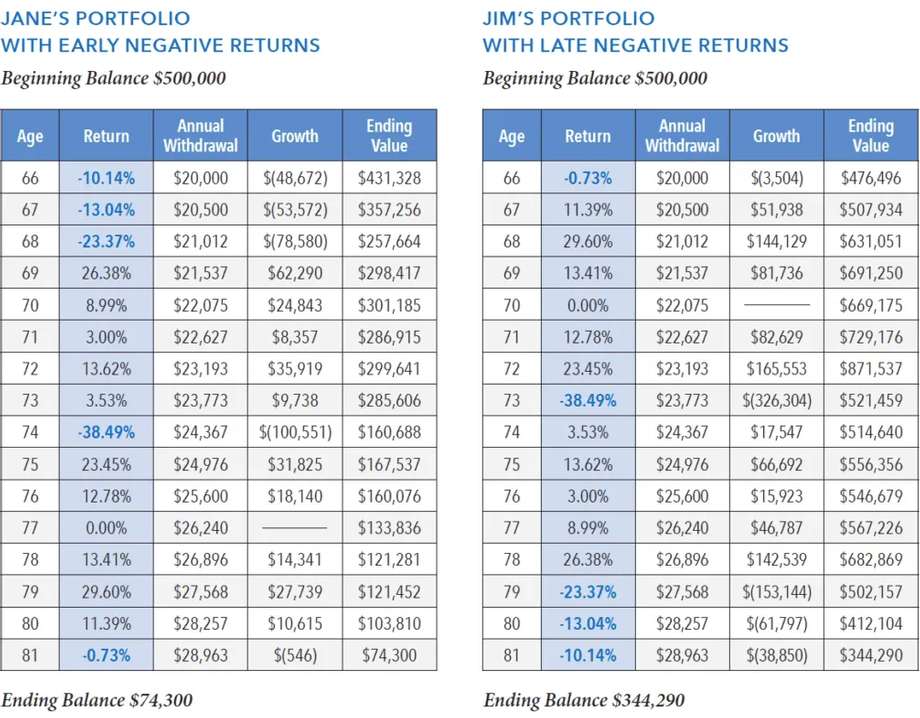

To understand how sequence of returns risk can impact retirement savings, let’s look at a hypothetical example involving two investment portfolios. In this hypothetical example, “Jane” and “Jim” retire at the same time, each with a $500k portfolio. Let’s assume that over a 15-year period, each portfolio takes out the same amount of money and receives the same rates of returns… the only difference is that Jane gets her negative returns early in retirement where Jim will get his negative returns late in retirement. As you can see below, Jane’s returns are in the reverse order of Jim’s returns.

Source: Lafayette Life Insurance Company

Needless to say, you would much rather be Jim 15 years into retirement as he had $269,990 more in his retirement portfolio when compared to Jane’s portfolio. The good news is here at The Price Group, we utilize several strategies to help mitigate the sequence of return risk in retirement.

Asset Allocation

The most basic strategy is to evaluate your asset allocation. Every investor should regularly confirm that their investments are properly diversified across equities, bonds and possibly other alternatives. Proper asset allocation can help reduce risk during market downturns, which are so damaging in those early years of retirement. We tell families approaching retirement that they should understand their target risk budget and have their portfolio properly invested 3 – 5 years before retirement. Murphy’s law is that you plan to retire at the end of this year but the market has a 20% pullback between now and then and you are forced to work an extra 6, 9, or even 12 months waiting for the market to recover if you are taking too much risk in the months leading up to retirement.

Stress Test with Monte Carlo Simulation

Here at The Price Group, we stress test your portfolio prior to retirement with our Live Well Plan. We do this by showing you going through retirement 1,000 times and providing you with a probability of success of meeting your goals. During these 1,000 trials, we account for poor market timing early in retirement. We are looking for each client family to be in the “green zone” with 75% - 90% of their trials being successful. We also create your Family Index Number – a personalized benchmark that gives clients their rate of return goal over during retirement. The Family Index Number helps clients understand if they are ahead of track, behind track, or right on track.

Income, Income, Income

We are big believers that retirement portfolios should focus on producing income. If you are only spending the income that your investment portfolio generates (dividends + bond interest) and not touching the corpus of your portfolio, the sequence of returns does not affect you nearly as much. This is true if companies continue to pay the same dividends even when their stock price moves lower… this is why we focus on companies that have historically been resilient in paying dividends even during periods of negative returns.

The Bucket Approach

A bucket strategy can help protect your savings by allocating investments into three buckets: short-term, mid-term and long-term. The short-term bucket includes low-risk assets and cash to be used for immediate expenses, while the mid-term bucket holds lower-risk investments and the long-term bucket focuses on investments that can generate growth. This approach can help mitigate sequence of returns risk by ensuring that short-term needs are covered by low-risk assets. Here at The Price Group, we do this by building a short-term CD ladder for any expenses that are needed in the first few years of retirement. This allows the client to know that no assets will have to be sold at the “wrong” time. To replenish your short-term bucket, assets are periodically reallocated—money is moved from bucket two to one and then from three to two.

Conclusion

Investing while working is drastically different than investing in retirement. Because of this and the fact that a mistake leading up to retirement can be so costly, we encourage families to find a team that specializes in retirement planning. You worked an entire career building your retirement nest egg. Now you need a team of professionals that have spent their entire career helping families plan for and walk through the complexities of retirement.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

The example in this article does not take into consideration taxes, fees, and other money that is needed to invest which may reduce any outcomes. Actual results will vary. Asset Allocation and diversification do not assure a profit or protect against loss in declining financial markets.

Monte Carlo Analysis is a mathematical process used to implement complex statistical methods that chart the probability of certain financial outcomes at certain times in the future. This charting is accomplished by generating hundreds of possible economic scenarios that could affect the performance of your investments. The Monte Carlo simulation uses at most 1000 scenarios to determine the probability of outcomes resulting from the asset allocation choices and underlying assumptions regarding rates of return and volatility of certain asset classes. Some of these scenarios will assume very favorable financial market returns, consistent with some of the best periods in investing history for investors. Some scenarios will conform to the worst periods in investing history. Most scenarios will fall somewhere in between. The outcomes presented using the Monte Carlo simulation represent only a few of the many possible outcomes. Since past performance and market conditions may not be repeated in the future, your investment goals may not be fulfilled by following advice that is based on the projections.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease or totally eliminate their dividends without notice.

AdTrax 4766787.137 Exp 04/25