The ‘top ten’ is a term that is used a lot whether it is pertaining to college football rankings, where you finished in your high school graduating class, or a list of your favorite books. As it pertains to investing, the ‘top ten’ largest stocks is something that is studied by many. We thought it helpful to study the ‘top ten’ stocks in the S&P 500 to glean some insight on how this can affect investing returns moving forward.

Should We Just Buy 'The Market'?

We are asked this question often by prospective clients. And it is a very good question. Our answer is this….we think there are periods where passive investing (owning the S&P 500 through a mutual fund or ETF that tracks the S&P 500) can work out well. There are other periods of history where owning the market has not worked out well. Historically, these trends of this type can last from 10 – 20 years. Starting in 2020, we started to believe that we were entering a period where active management (stock selection) was going to be more important than it was in the previous 10 years… so far, that has been the case.

There are three main reasons why we have recently moved away from being less comfortable owning the overall market than a targeted group of stocks. Let’s discuss these ideas in more detail.

Reason #1: Is Concentrated Diversification Actually Diversification?

The S&P 500 has become extremely concentrated when compared to historic measures. The “Magnificent Seven “ largest stocks in the S&P 500 (i.e. Apple, Microsoft, Tesla, Nvidia, Meta, Alphabet, and Amazon) make up over 33% of the S&P 500. For context, this is the highest concentration reading of the S&P 500 dating back to the mid-70’s. (Russell Investments)

Reason #2: Roller Coaster of Returns

Depending on their individual situations, we believe many families approaching retirement should own stocks to combat inflation but many families we speak with do not want to invest 33%+ of their retirement stock portfolio in 7 growth companies that pay little/no dividend income for obvious reason. In 2022, when the broad market was down approximately 19%, but the “Magnificent Seven” lost almost 50% of their value. (Russell Investments) Needless to say, the “Magnificent Seven” offer much more volatility than many retired families want to experience.

Reason #3: Past Performance Does Not Dictate Future Results

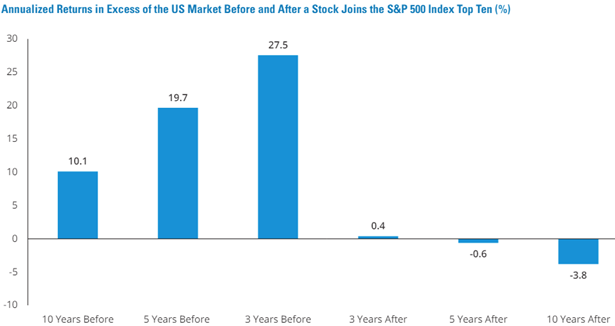

This is a common phrase found in the ‘fine print’ when studying performance of all investment companies. As you can see below, the gains leading up to earning the title as a ‘top ten’ stock are well above the market averages. However, the ‘top ten’ stocks tend to underperform the overall market over the following 3 and 5 years’ time frames after receiving this title. (Russell Investments: Market Concentration and the Magnificent Seven) I am reminded of the book by Marshall Goldsmith titled “What Got You Here Will Not Get You There.”

Source: Hartford Funds: FactSet

Conclusion

We are of the opinion that controlling risk and producing income continue to be the two most important themes for retired stock investors. Moving forward, we continue to believe dividend paying stocks make the most sense for many families approaching retirement (or currently retired). Owning high quality dividend paying stocks usually means staying away from the latest ‘trendy’ stock that has had an above average historic run and inflated future expectations.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. All investing entails risks that investors should endeavor to understand before then invest. Past performance is no guarantee of future results.

Diversification does not assure a profit or protect against loss in a declining market. Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease, or totally eliminate their dividends without notice.

The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks. An investment cannot be made directly in a market index.

AdTrax 6555474.4 Exp 04/25