Stocks got off to a good start during the first 9 months of 2024. Honestly, the overall stock market moved higher than we had projected at the beginning of the year… something we are okay being wrong about!

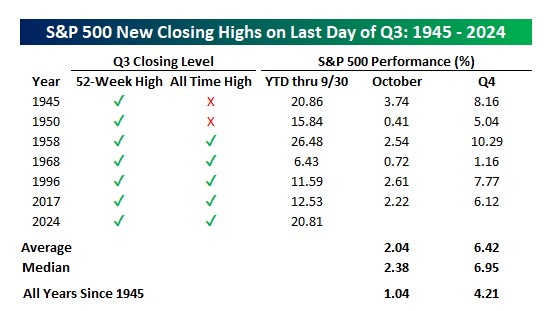

We thought it helpful to study how the market performed during the last 3 months of the year (4th quarter) when a new all-time high for the market was made on 9/30 (end of the 3rd quarter).

As you can see below, the average 4th quarter return during the previous 6 years when an all-time high was made on 9/30 resulted in a positive return for stocks averaging between 6% and 7% during the last 3 months of the year.

Source: Bespoke Investment Group 2024

As we have said many times… history does not repeat itself but it often rhymes. With that being said, the last 3 months of the year have historically been the strongest quarter for stocks. This is sometimes referred to as seasonal strength because of the “Santa Claus rally” which can sometimes take place the 2nd half of December.

Now, let’s consider some information that can be used as a rebuttal to the statistics detailed above… Do we have a presidential election coming up? Is there growing geopolitical uncertainty in the Middle East? Have several major ports temporality closed due to a recent labor strike?

While any of these issues might cause a temporary stock market pullback, we do NOT believe these questions should cause investors to abandon their long-term investment strategy. We will continue to monitor each of these issues closely and make the necessary changes to client discretionary portfolios as we deem appropriate.

Want to review your investment portfolio or talk more about the advantages of dividend paying stocks? Give us a call. We love to hear from clients during good and choppy markets!

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is no guarantee of future results.

Matt Price is a Wealth Manager with Steward Partners participating in the Steward Partners Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Wealth Manager invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Steward Partners ADV Part 2, available at https://adviserinfo.sec.gov/Firm/283004 or from your Wealth Manager.

AdTrax 6555474.16 Exp 10/25