This week in our three-part series on the election, we will look at how investors have historically behaved before and after elections, market performance in the months after an election, and a study of what type of stocks have historically performed best after an election.

Follow The Money

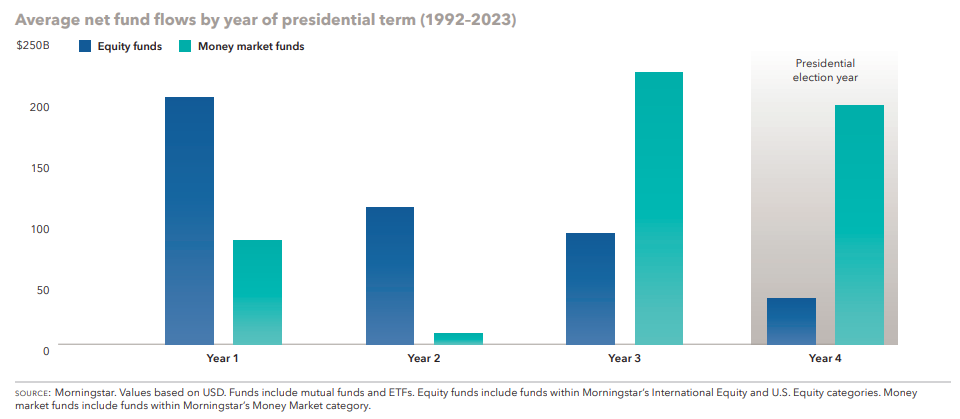

When looking backwards, it is easy to tell when investors become apprehensive about the markets as this is historically signaled by a reduction in risk assets (stocks) and an increase in conservative assets like money market funds and fixed income. Below you can see that years 3 and 4 of a presidential election cycle have seen a MUCH higher addition to conservative assets like money market funds with the lowest addition to stocks. It is no surprise that year 1 of a presidential term has historically seen the highest allocation to stocks as investors have a better grasp on what to expect for the next four years as it pertains to monetary and fiscal policies. As we have written about many times, markets do not like uncertainty. This is evident as the highest additions to equities have happened during the first year of a presidential cycle when uncertainty is arguably at its lowest level.

What does this mean to you? “Waiting to see what happens after the election” can result in missing out on potential gains in the market. With the 1st year of a presidential cycle having historic positive returns, we generally recommend staying invested during this election season.

How Have Stocks Performed In The Months AFTER An Election?

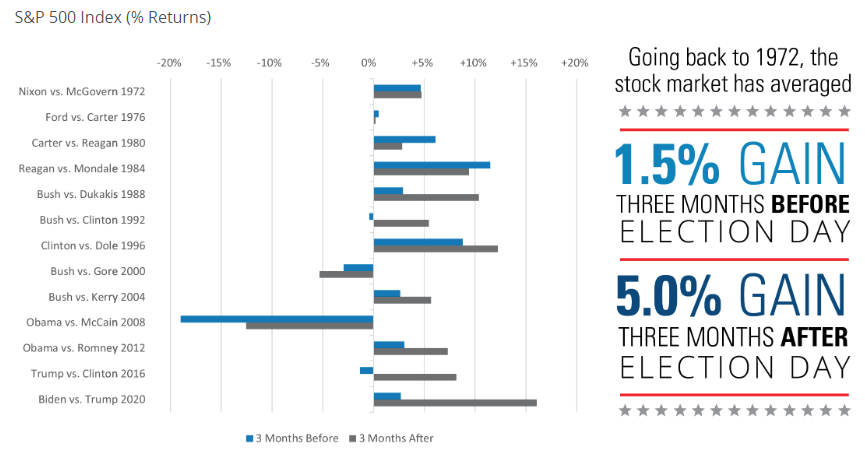

On average, stocks have historically moved higher by 5% in the three months after presidential elections dating back to 1972. Part of the “wind at the back” for the markets in the months following an election is the fact that November and December are seasonally strong months for stock market returns. While Republicans have produced higher returns in the months after an election, Democrats have also produced positive returns.

We think Warren Buffett said it best: "I don't try and guess when to get in and out of the market. I have owned stocks consistently since 1942. I was buying stocks the day before the election. I was buying the same stocks the day after the election."

Source: Morningstar 1/1/24

What Type Of Stocks Perform Best AFTER An Election?

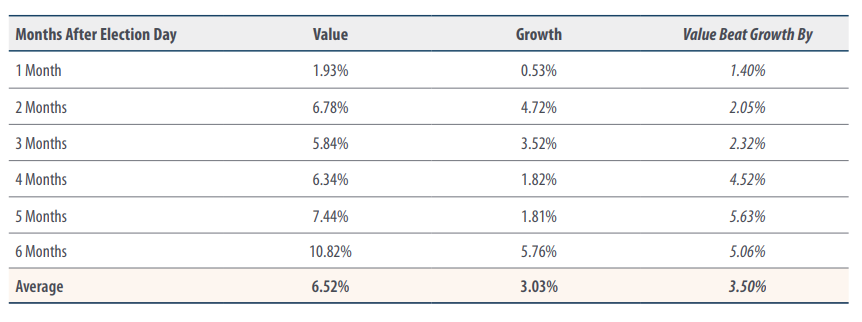

Moving forward, we are of the opinion the type of stock you own is very important. We think the days of a select few technology stocks pulling the entire market higher are behind us. As our readers know, we have an infinity for dividend paying stocks which can be described as “value” companies opposed to “growth” companies. As you can see below, value stocks have historically outperformed growth stocks by a pretty wide margin (5%+) in the 6 months following presidential elections. We believe this is another reason to favor dividend stocks in the coming months.

Source: Bloomberg 12/31/23

Drown Out The Noise & Focus On Fundamentals

The noise of politics can be deafening leading up to an election. Long-term market moves are more likely to be driven by economic fundamentals, such as corporate earnings, interest rates, and other economic factors. While political headlines can and will cause short-term dips in the market, history suggests that these dips are temporary. We believe focusing on the fundamentals over the next few months is prudent advice for the long-term investor.

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. All investing involves risk including possible loss of principal. There is no guarantee that any investment strategy mentioned will be successful. Past performance is no guarantee of future results.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease or eliminate their dividends without notice.

AdTrax 6555474.18 Exp 10/25