Humans tend to think in a linear fashion. For example, if it has rained for the past 10 days, we think it is going to rain forever. After the 2008/2009 market meltdown, investors became very interested in dividends because the stock market was down approximately 40% in 2008. During this time period, most companies continued to pay dividends even as the price of their stock plummeted. Because of this, dividend income was one of the few beacons of hope during the tumultuous financial crisis.

Recently, it seems that investors have forgotten how important dividends are over a market cycle due to the strong total return of the stock market over the past 10 years. My goal is to illustrate how important dividends are for the retired investor. Profits from total return are merely an opinion of the stock market while dividends are hard dollars in your pocket.

Why Own Dividend Paying Stocks?

The dependability of dividends is one of the main reasons retirees should consider dividend paying stocks for the equity portion of their portfolio. A steady dividend stream provides dependable income for investors who need to take money out of their investment portfolio for expenses in retirement.

For example, Procter & Gamble has paid a dividend every year since 1891. While Procter & Gamble's stock price has not risen every year since 1891, shareholders who owned the stock at least got paid during those down years. They weren't totally dependent on the appreciation of the stock. This is not a solicitation to buy Procter & Gamble’s stock.

Dividend Contribution To Total Return

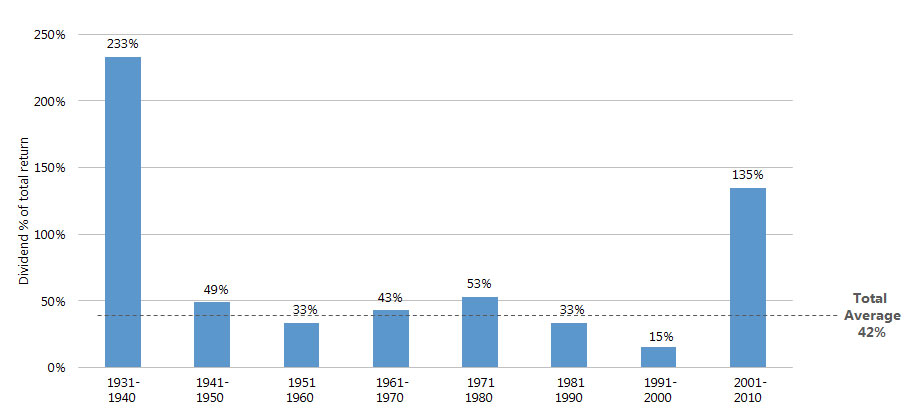

The image below shows the importance of dividends to total return over the past 8 decades. Dividends have accounted for approximately 42% of total return of the stock market during this time period!

Fight Inflation

Retirees should also consider owning dividend paying stocks due to their ability to hedge against inflation. Inflation in retirement is like a hidden tax and consistent dividends are a strategy to help offset the pressures of inflation as the cost of goods and services continues to rise.

Payback of Initial Investment

Some investors like to think about dividends as a safety-net to equity investing. Nobody knows for sure if a stock will go up, go down or move sideways but viewing your dividends as a payback of your initial investment can help establish an expected baseline performance.

Focus on Rising Dividends

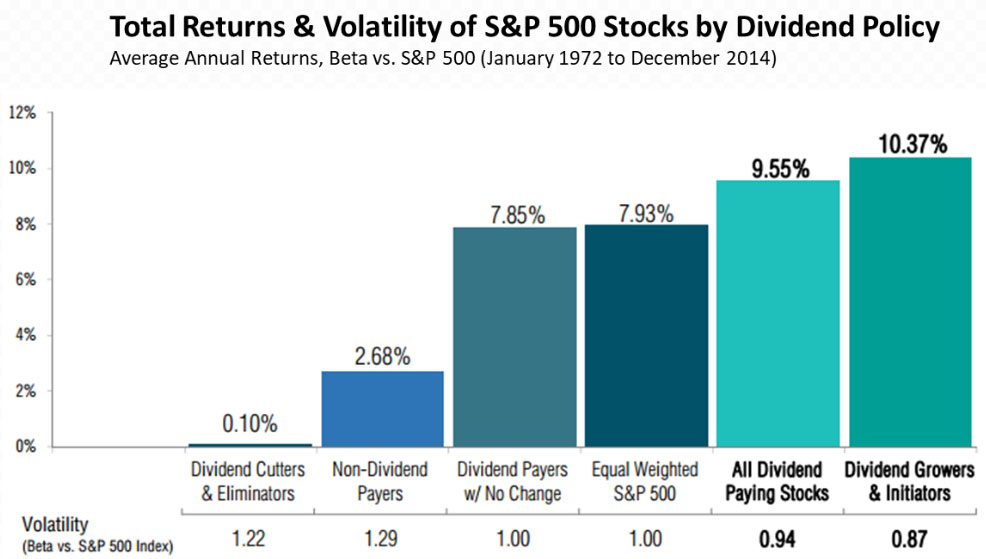

Companies that have the ability to increase their dividend year over year typically are the most healthy and viable companies to withstand a downturn in the market. As you can see below, dividend growers have outperformed dividend paying stocks.

Conclusion

Focus on dividends. More specifically, focus on companies that have a propensity to increase their dividend year over year.

Any opinions are those of the author and not necessarily those of RJFS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investments mentioned may not be suitable for all investors. Dividends are not guaranteed and must beauthorized by the company's board of directors. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index. Source 1: https://thereformedbroker.com/2012/10/17/5-things-i-learned-about-dividends-from-pimco/ Source 2: https://seekingalpha.com/article/4202869-dividend-focused-etfs-performed-bull-bear-markets