Overview

Did the subject line of this email catch your attention? It most likely did as there is considerable talk and discussion about the timing of the next recession.

A recession (i.e. two consecutive quarters of negative GDP growth) is coming. We guarantee it. Unfortunately, we do not know when. It is kind of like saying we know another hurricane will hit Houston. We know it will but we just do not know when. Recessions will continue to happen as long as economic data is tracked with some degree of certainty. With that being said, the better question to ask could be “What can help us identify the next looming recession?”

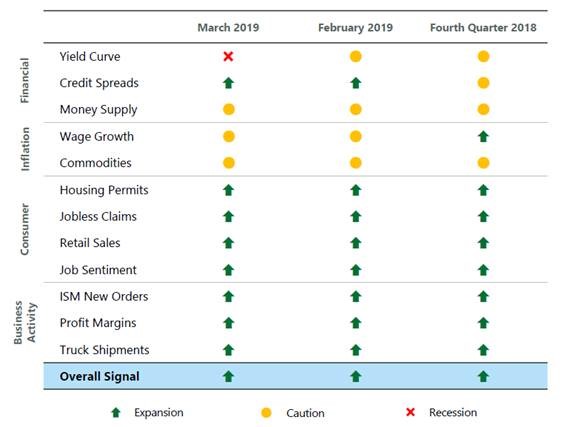

The Price Group Recession Indicators

The Negatives

- Inverted Yield Curve: Parts of the yield curve are inverted. This means that 13 month Treasury bonds are yielding more than the 10 year Treasury bond. Historically, this “inversion” of interest rates has happened prior to most every recession. With that being said, history tells us that an inverted yield curve does NOT always produce a recession. A good analogy would be… it always rains before a hurricane but rain does not always lead to a hurricane.

- Trade tension with China: This story and the resulting uncertainty just keeps dragging on. We feel like the real issue is not trade but the theft of intellectual property. The stock market has been negative for the last 5 weeks in part due to the concern about this uncertainty. The next chance to potentially come to an agreement with China would be at the G20 summit in July.

- Increasing amount of low quality debt: The amount of lower quality debt has been increasing. It could present an issue in the next economic downturn.

The Positives

- Healthy consumer: American households are in a strong financial position with robust balance sheets. Household leverage is the lowest it has been since 1985.

- Company Earnings: Earning still look healthy. We have written in the past that earnings growth could grow at a slower pace but this was to be expected.

- Corporate Balance Sheets: Large companies here in the U.S. are flush with cash.

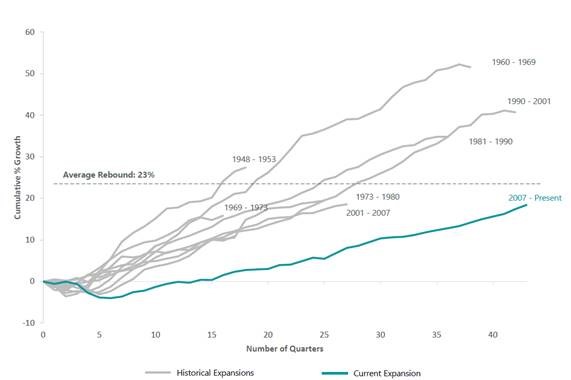

US Economic Expansions Since 1948

While this expansion/recovery has lasted 10 years, it has been “slow” in terms of the amount of growth.

Conclusion

We remain vigilant in our study and due diligence to track economic activity and make changes as needed to protect client capital. We remain of the opinion that a recession is not immenient. To be clear, we are not saying stocks will go up in the coming weeks or months. Corrections happen. But, given the level of corporate profits and our outlook for economic growth, we think that equities will move higher over the next 12 months.

As always, please let us know if you have any specific questions about the health of the economy or your Live Well Plan.