Perspective, Perspective, Perspective

“A recession is coming! A recession is coming! Quick – get worried and make drastic changes to your long-term retirement plan!” This is the common message we have heard from the media over the last few months. Why? There is a serious conflict of interest. The media can sell more ‘clicks’ or newspapers or ads on their website when the general public is fearful about the future. Perspective is everything when looking at the markets and your investment portfolio. The constant ‘noise’ from the media makes perspective difficult even for the seasoned investor. We recently hosted a webinar to help provide some perspective and discussed how we are navigating this market volatility for our clients. After the webinar, a long-time client emailed me and said “Thanks for the recent webinar. It is good to hear some sanity rather than the "sky is falling" mentality so often heard in the media today.”

Our advice in these turbulent markets continues to be this… trust your long-term financial plan. We call our plan a Live Well Plan. The goal with this plan is to provide comfort, confidence and clarity about your financial future during ALL types of markets. If you do not have a long-term financial plan, you are flying blind. You owe it to yourself to prioritize your financial future. You have worked too hard and too long to leave your retirement to chance!

The Wall of Worry

Bull markets traditionally climb a wall of worry and we continue to believe that we are in a bull market. Every cycle, investors grapple with negative news that could cause significant losses. The fear of losing can keep all us nervous nellies. Over the past few months, a trade war and slowing economy topped the list of concerns. Each time there was a bad series of reports from China or Europe, the stock market moved lower. When there were rumors of greater monetary stimulus, stocks moved higher. There has been a lot of movement (updrafts and downdrafts) in the stock market but the market has not really gone anywhere over the past few months.

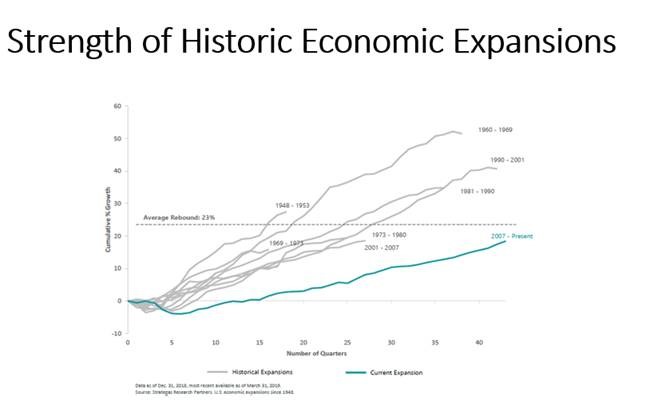

As you can see below, the current expansion is ‘long in the tooth’ but we are not even back to the average rebound of 23%. This is because the economic recovery has been like pushing a wet rope – it has been slow and tedious.

10 Things To Know About Bear Markets

- 20% is the number to watch: Market cycles are measured from peak to trough, so the stock market officially reaches bear territory when prices drop at least 20% from its most recent high. A new bull market begins when the closing price gains 20% from its low.

- Stocks lose 36% on average in a bear market.1 By contrast, stocks gain more than 108% on average during a bull market.

- Bear markets are normal. There have been 25 bear markets in the S&P 500 Index2 in the last 90 years. However, there have also been 26 bull markets—and stocks have risen over the long term.

- Bear markets tend to be short-lived. The average length of a bear market is 299 days, or about 10 months. That’s significantly shorter than the average length of a bull market, which is 989 days or 2.7 years.

- Every 3.6 years: That’s the long-term average frequency between bear markets. The longest the market has gone without a bear market was from December 1987 until the dot-com crash in March 2000.

- Bear markets have been less frequent since World War II. Between 1928 and 1945 there were 12 bear markets, or one about every 1.4 years. In the 73 years since the war ended, there have been 13—one about every 5.6 years.

- Nearly half (48%) of the S&P 500 Index’s strongest days occurred during a bear market. Another 28% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun.3 In other words, it is near impossible to time the market.

- A bear market doesn’t always indicate an economic recession. There have been 25 bear markets since 1929, but only 14 recessions during that time.4 Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming. A recession is just two consecutive quarters of a shrinking economy.

- Assuming a 50-year investment horizon, you can expect to live through about 14 bear markets. Although it can be difficult to watch your portfolio dip with the market, it’s important to understand that downturns have been temporary.

- Bear markets are painful, but markets are positive a majority of the time. Of the last 90 years of market history, bear markets have comprised only about 20 of those years. Put another way, stocks have been on the rise 77% of the time.

1 Source for bear/bull market stats is Ned Davis Research as of 12/31/18 unless otherwise noted.

2 The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

3 Source: Ned Davis Research, 2/18. Time period referenced is 1/2/1998-12/31/2017.

4 Source: National Bureau of Economic Research, 1/19

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the author, and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Holding investments for the long term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected.