As a 7 year old, I remember watching The Wizard of Oz and partially covering my eyes for parts of the movie. One of the scariest scenes is when Dorothy, the Tin Man, and the Scarecrow are walking through the dark forest and they start to hear noises in the foliage around them. The Scarecrow wonders if there are any animals out there who might be interested in eating things like… straw. Naturally, this causes the Scarecrow to anxiously repeat, "Lions and tigers and bears," and Dorothy throws in the good old "oh my" for dramatic effect. Pretty soon, the three characters are skipping through the forest chanting, "Lions and tigers and bears, oh my!"

In a similar fashion, we can sometimes feel like the Scarecrow when planning for our financial future – the forest is dark and there are plenty of things to worry about. The fact that there are things to worry about is nothing new – this has been the case since the beginning of mankind. We can promise there will be new economic reports, crazy events, geo-political tensions, and political drama to worry about this year, next year, and 10 years down the road. My grandmother used to say “it is always something”. And she was right.

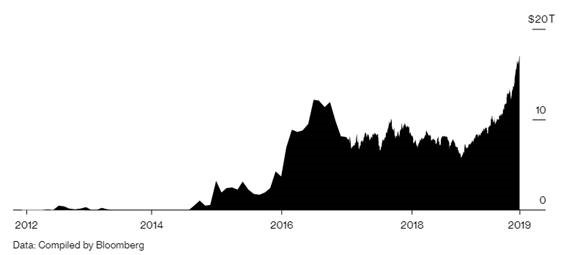

The Surge of Negative Yielding Debt

One of the main topics of concern over the past few months has been the discussion of negative interest rates. There are over 17 trillion dollars’ worth of negative yielding sovereign debt (country debt) around the globe! Think about the idea of negative interest rates for a minute… you walk into a bank and give the banker $1,000 to open a new checking account. The banker tells you that the interest rate that you will receive a negative interest rate meaning you (the investor) will be paying the bank to hold your cash! You have a guaranteed negative rate of return. This is not normal nor is this healthy for the global economy over the long haul.

The chart below details the surge of negative yielding debt over the past seven years:

America is the Cleanest Shirt in the Dirty Laundry

Thankfully, interest rates in the U.S. are not negative. We have seen interest rates here in the U.S. move lower this year. Why? There are quite a few reasons to explain lower interest rates. One of the main reasons is that global investors are looking for the highest yield (income) in a stable currency. If you live in Germany and need income, would you rather own the German 10 year government bond with a negative interest rate OR the U.S. government bond yielding approximately 1.7% (at the time of writing this blog post)? It is an easy answer, right? It also does not hurt that the U.S. dollar has been appreciating. In our opinion, this phenomenon has artificially reduced interest rates here in the U.S. There are investors around the world who have been buying U.S. debt because America is currently the “cleanest shirt in the dirty laundry.”

Government Intervention

Why is this happening? How did we get here? Most of you have heard the term ‘quantitative easing’. This is a relatively new (and somewhat complicated and controversial) strategy where the Federal Reserve and other Central Banks have attempted to help their economies grow (or grow at a quicker pace). One of the ways that governments have tried to spur growth since the 2008 financial crisis has been to reduce short term interest rates. Governments around the world quickly lowered interest rates in 2009 to stimulate the economy, encourage more investment, and to influence investors to invest more of their capital into risk assets (i.e. stocks). Has this strategy worked? Is this a sustainable strategy? Stay tuned as there continues to be a robust debate when trying to answer these questions.

The Bond Bubble

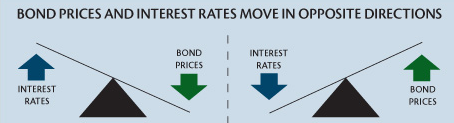

When interest rate move higher, bond prices move lower. Where do interest rates go from here? If you can answer that question with certainty, we want to hire you! All joking aside, if you are a student of history, you typically see interest rates move lower when there is a global slow-down or recession. Interest rates typically rise during times of economic prosperity. We are currently in unchartered territory as the U.S. economy has continued to expand for the last 10 years but interest rates continue to be lower than long term averages. As mentioned earlier, we feel like interest rates here in the U.S. are artificially low due to global demand for our relatively high interest rates. What happens if/when interest rates rise around the globe? Do investors move their bond investments out of the U.S. and back to their own country? If so, we could see interest rates increase here in the U.S.

The Take Away

Historically, interest rates move in 30 year cycles. Since the 1980’s, we have seen interest rates move lower here in the U.S. At some point, we will see interest rates rise. What is your investment process to invest in bonds/fixed income? The strategy that has worked well for the past couple of decades will likely not be the best strategy over the next 30 years. There are 14 sectors within the bond market. Some sectors carry credit risk (i.e. high yield/junk bonds), some sectors carry low interest rate risk (i.e. floating rate bonds), and other sectors are very sensitive to changes in interest rates (i.e. long-term government bonds). Bottom line – the discrepancy between different sectors in the bond market is magnified in a rising interest rate environment. It is very important to have a defined process for how you invest your bond portfolio.

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary here. We are helping make the complex simple.

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their two daughters and their family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 9 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Prior to making an investment decision, please consult with your financial advisor about your individual situation.