When I hear the word ‘bubble,’ my first thought is about playing with bubbles in our backyard with my two girls. When we pull out the bubbles, it never ends well. Someone always spills the bubbles or the bubble liquid gets one of the girls wet and someone starts to cry. Dad is the one responsible for cleaning up the bubble residue (which is harder than it sounds). Needless to say, Dad tries to avoid bubbles at all cost.

In a similar fashion, we try to avoid investing in market ‘bubbles’ for our clients at all cost. How was that for a cheesy transition?

Define A ‘Bubble’

A bubble is created when asset prices have risen to an unsustainably high level, driven by unrealistic expectations and euphoria. When prices experience a reversion to the mean, asset prices typically reach a point where they quickly drop in the process. If you think back to the dot-com boom, and the housing boom, you see that this definition captures both ‘bubbles’ very well.

Are We In A Stock Market Bubble?

A number of price-based indicators would say ‘yes.’ Whether you look at sales, book value, earnings, or most price-based metrics at all, stocks do look ‘expensive’ by historical norms. With that being said, we do not think these metrics tell the entire story. Bottom line… We do not think we are in a stock market bubble right now. Let us explain why.

Interest Rates & Stock Prices

Stocks do not stand alone in the financial universe, but rather compete with other assets—specifically, bonds. The higher the bond interest rate, the more attractive the bond is compared with stocks. Therefore, for an investor, there is a direct relationship between interest rates and stock prices.

Think about it. Over time, the stock market has returned around 8% to 9% per year. If you could buy a risk-free U.S. Treasury bill giving you the same rate of return, wouldn’t you buy that instead? Why take the risk involved with stocks if you don’t have to?

When interest rates are low (i.e. current period), stocks are more attractive. Why would you want to own a 10-year U.S. government bond yielding 1% when you can own a collection of dividend-paying stocks paying over 2%? When interest rates go down, you would expect stocks to go up. And this relationship is what we have seen.

Bottom line… the Federal Reserve has moved short-term interest rates to almost zero. This has been a passive way to ‘force’ investors to buy risk assets (i.e. stocks).

We expect longer term interest rates to move higher over the next 12 months but not to the point where stocks become unattractive.

Historical Earnings Per Share (EPS)

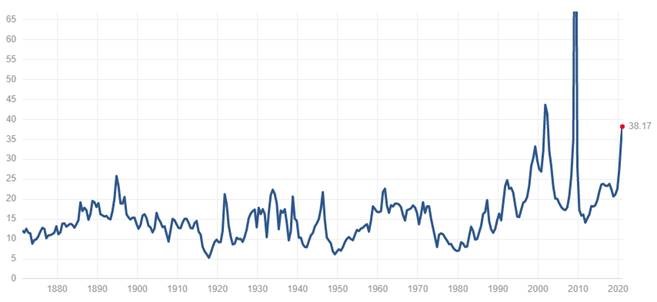

When evaluating the earnings of a company, one must use historical data over the past four quarters. Given that the world temporarily shut down in 2020, a look in the rearview mirror paints a very bleak picture for stock market valuation. This same thing happened in 2009 following the Great Recession caused by the 2008 financial crisis. The highest price-to-earnings (P/E) ratio on record came in May 2009 at 123.73. To provide some perspective, the long-term P/E ratio average is 15.88. Looking back, May 2009 was one of the best times to buy stocks in our lifetime!

As you can see in the graph below, the current valuation is elevated when compared to historical numbers. But remember, we are looking in the rearview mirror when many companies were forced to shut down. Just as we experienced in 2009, we think companies today will recover and grow their earnings. Over a long period of time, the stock market will continue to move higher if companies can continue to earn more money.

Source: Robert Schiller and his book Irrational Exuberance for historic S&P 500 PE Ratio.

What Does This Mean To You?

You NEED an investment process that is repeatable and takes the emotion out of investing. You can read more about The Price Group’s investment strategies here.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Any opinions are those of The Price Group and not necessarily those of Raymond James. This material is being provided for informational purposes only and is not a complete description, nor is it a recommendation. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Dividends are not guaranteed and must be authorized by the company's board of directors. Past performance is no guarantee of future results