Tom Brady (at age 43!) just won his 7th championship earlier this month. As a University of Tennessee graduate and an avid Peyton Manning fan, it is hard for me to admit that Tom is indeed the G.O.A.T. (greatest of all time).

We thought it helpful and maybe interesting to review a few companies that were alive, thriving and advertising when Tom won his first ring back in 2002.

• AOL

• Blockbuster

• Radio Shack

• Circuit City

• CompUSA

• Sears

• HotJobs

• Yahoo

• VoiceStream Wireless

• Gateway Computers

Notice anything in common with the companies listed above? While a few are still in business, a majority of them are not. A LOT has changed in the past 19 years, and this should serve as a good reminder of the benefits of diversification and also the need for a repeatable investment process. These two ingredients are vitally important for long-term success as it pertains to investing.

The Price Group’s Investment Process

Investment discipline and income generation are the core principles/foundation of our process-driven investment strategies. In most cases, multiple investment strategies are selected based on your personal situation in order to achieve your Family Index Number. Our ultimate goal is to preserve your retirement capital while generating income (with growth) necessary to meet your personal goals and objectives. Our process is designed to generate clarity, comfort, and confidence.

Highlighting One Of Our Strategies – Dividend Growth

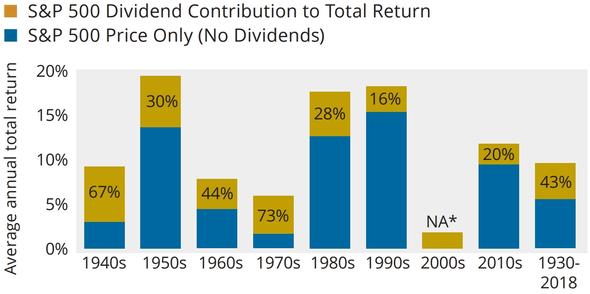

We have 15 different investment strategies we manage for clients. We thought it helpful to highlight our Dividend Growth model as an example. In this strategy, we are looking for companies that not only pay dividends but have historically increased their dividends year-over-year. As you can see below, dividend income contributed 43% of the stock market return for the 88-year period ending in 2018.

Sources: Morningstar and Hartford Funds, 1/19.

What Does This Mean To You?

A prudent and repeatable investment process is critical to making sure the companies you own are alive and viable in 19 years when Tom Brady wins another one.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Dividends are not guaranteed and must be authorized by the company's board of directors.