Poor Taste For Your Next Date Night

Men – you can’t say that I didn’t warn you. The 4% rule is not a good topic of conversation for your next date night, but it is important to study and understand if this time-tested strategy will continue to offer prudent spending advice for future retirees.

The 4% Rule Explained

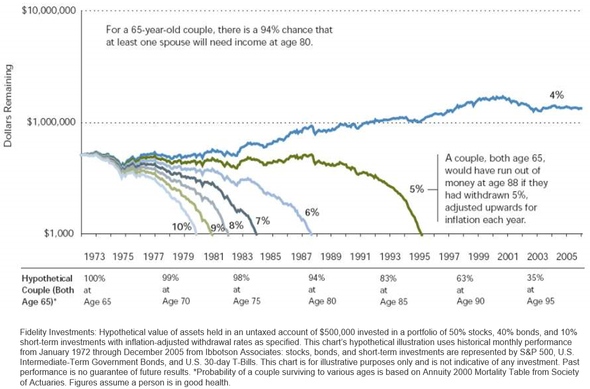

The 4% rule comes from several academic articles and suggests a retiree can take a 4% inflation-adjusted distribution every year from his/her retirement portfolio while maintaining confidence that he/she will not run out of money. This “rule” has been used for decades to help retirees plan for and walk through the complexities of retirement. Historically, the 4% rule has a good track record of providing accurate feedback.

The Dangers of the 4% Rule

Marshall Goldsmith, a nationally recognized author, famously said “What has got you here will not get you there.” We think Mr. Goldsmith’s catchy phrase applies to retirement planning and more specifically… the 4% rule. This historical study was done using data from the 70’s, 80’s, and 90’s. During these decades, interest rates were much higher than interest rates are today. As we write this blog, the 10-year U.S. Government bond is yielding less than 1.3%. This is compared to the average interest rate of 5.4% for the same bond dating from 1970 to 1999. Needless to say, the fixed income (i.e. bond) portion of your investment portfolio is not yielding nearly as much as it used to when this 4% rule was established. Because of this, we are apprehensive to blindly follow the 4% rule.

Is 3% the New 4%?

Possibly. There are many factors to consider in the calculation of how much you can safely take from your retirement portfolio. How long are you expecting to be retired? Do you plan to spend the same amount of money for your entire retirement? What “big ticket” items will you need to purchase? How is your health? Do you expect to need long term care or assisted living at some point? Do you still have a mortgage? What is the mix of stocks vs. bonds in your portfolio? Will there be inflation? What will be the investment returns over the next 10 years? Do you want to leave your children an inheritance?

These are some big questions, and a lot of them are difficult to answer. The calculation to accurately estimate how much you can spend in retirement is more difficult today than it was 10, 20, or even 30 years ago. Because of this, we think that ALL investors who are approaching retirement (or are currently retired) need to have a formalized and written wealth plan that uses Monte Carlo simulation to help them navigate the maze of retirement planning. Monte Carlo simulation projects your retirement thousands of times and uses different historical returns and which includes the current lower interest rates and also large stock market pullbacks like we experienced in 2008, 2020, etc. This provides you with statistical data to help you make some of the difficult decisions as you approach and walk through retirement.

While our planning process will not tell you what stock market returns will be over the next year or where interest rates go from here, our retirement planning process (which we call our Live Well Plan) uses conservative assumptions that will afford you the ability to plan for your future in a more precise fashion. Our Live Well Plan ultimately offers clarity, comfort, and confidence as it pertains to your financial future.

Want to review your Live Well Plan? Or maybe you want help creating a Live Well Plan for your family Give us a call.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Source: 3700757