Randy and I often say that we don’t make short-term stock market predictions. Why? Because Warren Buffett says “neither I nor you are smart enough to predict where the stock market will be in a year from now.” Randy and I will make other predictions though. I will predict that the sun will come up tomorrow. I will predict that I change at least three dirty diapers before I go to bed tonight. I will predict that The University of Tennessee football team will not be that good this fall. I will also predict that investors will continue to be irrational for years to come.

Humans constantly make irrational decisions because we prioritize our emotional well-being above all else. We all do this whether you realize it or not. According to a recent Harvard study, it is estimated that 90% of the decisions you make every day are based on emotion – not on rational thought and measured consideration. Said another way… the emotional tail will wag the rational dog. This is not a negative thing, but this was part of our design. While emotions are vitally important to your life, they often influence us to make poor investment choices.

The Price Group has been advising clients for over 38 years, and we have seen this irrationality play out in many ways. We have seen clients become too eager to buy stocks when markets perform well. We also have seen clients request to sell stocks at “the wrong time” during a market correction. We have seen clients want to sell a large portion of their portfolio to buy gold/silver. We have seen a retired client want to purchase a concentrated position of a foreign technology stock that paid no income. And there are dozens of other stories we could tell on this subject. While we will advise clients against such behaviors, we sometimes do not “win” the argument. Our clients are highly intelligent people, but emotions are a powerful force.

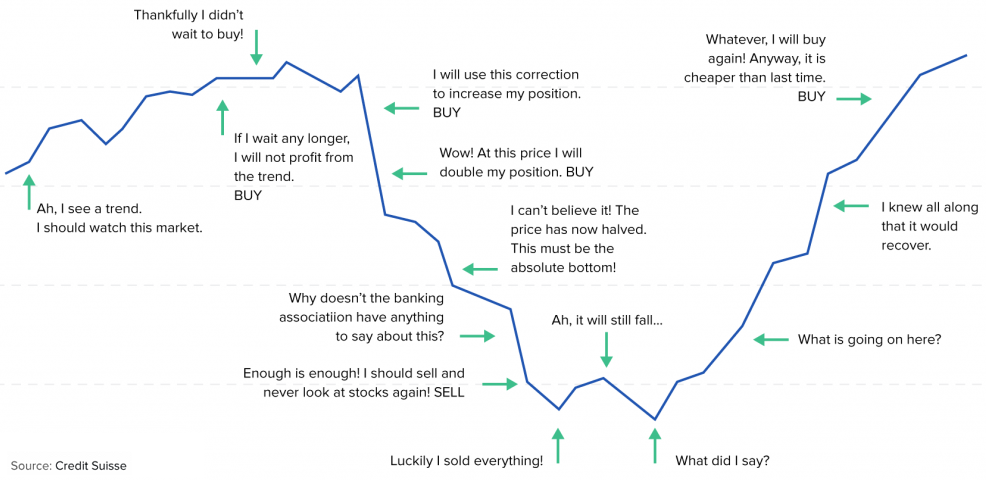

Below is a good look at the various emotions investors can experience during a market cycle:

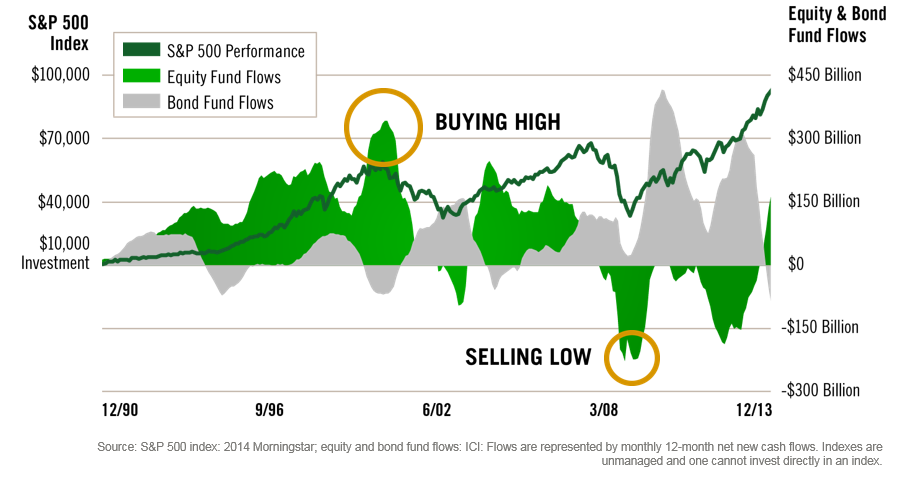

Buying High & Selling Low

Yes – I meant to say this backwards. Why? Because this is exactly what happened to a lot of investors in 2007 - 2009. The chart below is a busy chart, but it illustrates the unfortunate outcome for MANY investors who made emotional decisions during a very volatile period.

The dark green line represents the overall stock market (i.e. S&P 500), and the light green represents fund “flows” (i.e. when people were adding/subtracting from stock mutual funds). As you can see, the highest equity purchases were at the peak of the market in 2007 and the largest selling of equity mutual funds happened as the market bottomed in the spring of 2009.

You NEED An Investment Process

Following day-to-day market movements is time consuming and can cause unnecessary anxiety. Unfortunately, many investors often make poor financial decisions during stressful periods when emotions get in the way of reason and logic. We always want our client to buy LOW and sell HIGH.

Discipline and income generation are the core principles of our process driven investment strategies. Multiple strategies are selected based on your personal situation in order to achieve your Family Index Number. Our ultimate goal is to preserve your assets while generating the level of income and growth needed to meet your goals and objectives with clarity and confidence. We are fully convinced that it is nearly impossible to achieve long-term success as an investor without a written investment process. You can read more about our different investment strategies here.

About the Author

Matt Price serves as a Partner and Senior Vice President for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their three children and the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 10 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes that everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Sign up to receive our weekly commentary HERE. We are helping make the complex simple.

Source: 3700767