A Good Start?

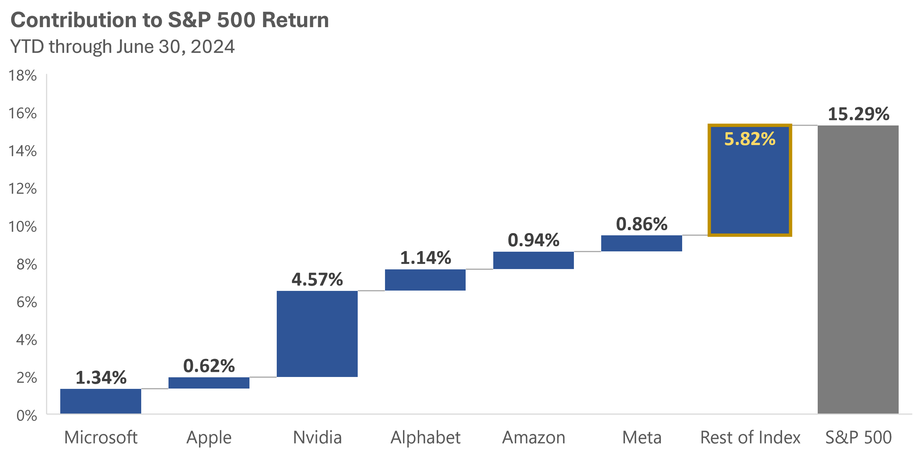

The overall stock market (S&P 500) had a solid first half of the year. At a glance, this looks to be all good news. If you were to take a closer look, you would find approximately 62% of the return came from only 6 stocks (see image below). We call this a “narrow market” meaning that only a handful of stocks are responsible for the overall performance of the S&P 500. When we look back at history, a narrow market is not always a healthy market.

Source: S&P Global, Bloomberg

Bifurcation of the Stock Market

Bifurcation is a big word for a Texas boy like myself but that is exactly what we are seeing in the stock market today. We are starting to view the stock market in two different camps… the 6 stocks listed above (sometimes referred to as the Magnificent 7 when you also include Netflix) and the rest of the market.

The overall stock market (S&P 500) started moving higher last September and never looked back… a major component of the positive returns for the entire market are due to the 6 technology stocks listed above. Moving forward, we believe the other 494 are well positioned to outperform the overall market.

What Does This Mean For You?

We believe the 6 largest stocks in the S&P 500 are overvalued. At the same time, we think the other 494 stocks are positioned to catch-up to this bull market over the next 3 – 6 months. The combination of higher earnings and lower interest rates have historically been catalysts for stocks to move higher. Do not be surprised if you see the average stock in the S&P 500 have positive performance during the 2nd half of 2024 while the S&P 500 index actually moves lower.

Our Dividend Growth Strategy

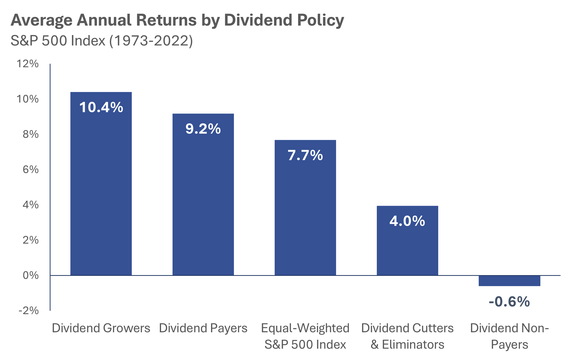

Yes – a majority of the Dividend Growth stocks that we own are in the “other 494 stocks”. There are a few camps of dividend stock investors out there. Some primarily seek high dividend income from the companies they own. Others desire that their dividends grow each year. While we like high dividend income, we gravitate towards prioritizing the growth of dividends.

History is clear that companies who increase their dividend are generally very healthy and likely to grow their stock price faster than other segments of the market... this is not just the opinion of The Price Group but backed up by historical evidence detailed below.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Sources: Hartford Funds, 12/22

About the Author

Matt Price serves as a Partner and Managing Director for The Price Group of Steward Partners. He resides in Houston with his wife, Emily, their four children and "Fisher" the family golden retriever. Matt studied at the University of Pennsylvania – Wharton School of Business for his Certified Investment Management Analyst (CIMA®) designation after receiving his undergraduate degree from the University of Tennessee - Knoxville. Over the past 12 years, Matt has helped families make high quality, common sense decisions regarding their wealth and their legacy. Matt firmly believes everyone needs a wealth coach!

Content Is Nothing Without Context

Are you looking for a weekly financial market commentary that provides context? Click here to sign up for our weekly newsletter. We are helping make the complex simple.

The views expressed herein are those of the author and do not necessarily reflect the views of Steward Partners or its affiliates. All opinions are subject to change without notice. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. All investing involves risk including possible loss of principal. Past performance is no guarantee of future results.

Equity securities may fluctuate in response to news on companies, industries, market conditions and the general economic environment. Companies cannot assure or guarantee a certain rate of return or dividend yield; they can increase, decrease or totally eliminate their dividends without notice.

AdTrax 6555474.8 Exp 07/26