Asking for a raise in the work place was considered one of the top conversations that caused anxiety per a recent study. Consider a LinkedIn survey of 2,000 professionals from around the world:

- 39% of American professionals are anxious about negotiating.

- 26% of women feel comfortable negotiating compared to 40% for men.

- Of the eight countries surveyed, professionals in the U.S. were the most anxious about negotiating.

But there is good news you will not have to ask for a raise from Uncle Sam for your Social Security paycheck in 2019!

History of Social Security Cost-Of-Living Adjustment (COLA)

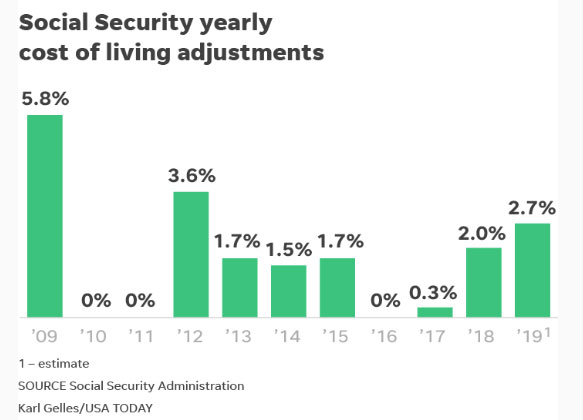

Each year, many of our clients eagerly await their cost-of-living adjustment (COLA) in the hopes of getting a higher monthly paycheck. Since 1975, retirees have received a COLA to help their benefits keep up with inflation. But in recent years, those COLA's have been notably stingy or non-existent.

It is also “interesting” to note that the government does not factor food nor energy into the COLA calculation. I still have not met anyone who does not consume food nor energy in their daily life. But the U.S. government did not ask for my opinion.

With that being said, it is encouraging to hear that recipients may be looking at a COLA that tops 3% going into 2019.

Will I really get a raise?

But before we go plan that beach vacation with our “raise”, let's remember that most retirees do not see their COLAs in full because of the "hold harmless" provision. The provision states that Social Security recipients can't see their benefits go down as a result of Medicare increases. Though this provision is designed to protect retirees from Medicare premium increases, it's also the reason why beneficiaries may not notice much of a change in their Social Security payments in the upcoming year.

Medicare Part B, which covers doctor visits, diagnostics, and preventive care is not “free” like Part A. The Part B premium can increase each year.

Since many of our clients pay for Medicare directly through their Social Security benefits, when Part B increases more than the COLA, enrollees are only on the hook for the lesser of the two. This means that if Part B goes up 5% in a given year but Social Security's COLA is only 3%, beneficiaries only will pay 3% more for Medicare.

Do you have a strategy?

Reviewing your Social Security filing strategy or your supplemental Medicare plan can be a daunting task. For example, there are 80+ ways for a married couple to file for Social Security benefits.

Before you try to decipher these complex government benefit programs alone, please give us a call. We would be happy to help.

Any opinions are not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Changes in tax laws or regulations may occur at any time and could substantially impact your situation. Raymond James financial advisors do not render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. Prior to making an investment decision, please consult with your financial advisor about your individual situation.